Columbia Bank IRA CD rates offer an enticing investment opportunity. Understanding these rates, along with the terms and conditions, is crucial for maximizing your returns. This comprehensive guide explores current rates, factors influencing them, and how they compare to other IRA options.

This guide will delve into the specifics of Columbia Bank IRA CDs, highlighting the advantages over traditional savings accounts. We’ll analyze current interest rates, examining the impact of economic factors and market trends. Understanding the implications of different term lengths on potential returns is also covered, along with a comparative analysis against other IRA options.

Introduction to Columbia Bank IRA CDs

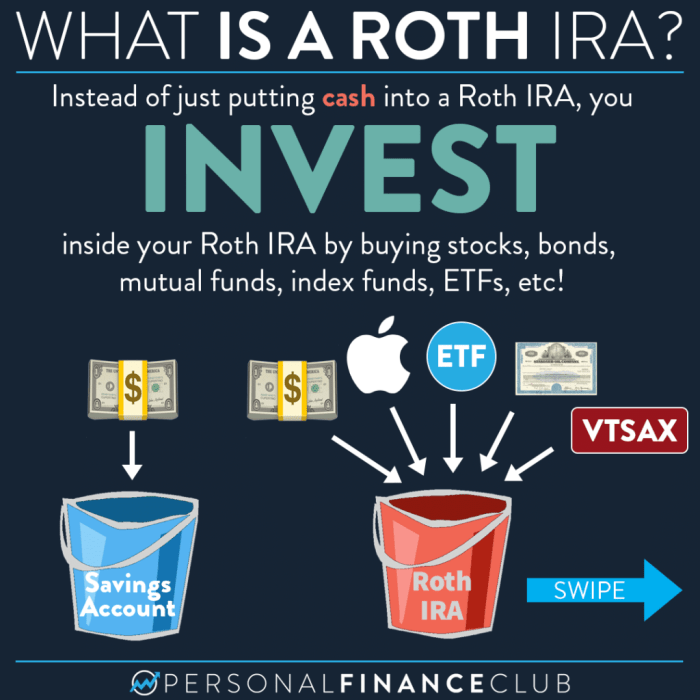

A Columbia Bank IRA Certificate of Deposit (CD) presents a unique investment vehicle designed for individuals seeking a secure, fixed-income avenue within the context of an Individual Retirement Account (IRA). Unlike traditional savings accounts, IRA CDs offer a guaranteed interest rate for a predetermined term, aligning with the primary goal of retirement savings. This structure offers a degree of predictability and potential for growth, distinct from the fluctuating nature of many other investment options.This specialized financial instrument combines the benefits of both an IRA and a CD.

The IRA component allows for tax-deferred growth on contributions, potentially reducing the present tax burden. The CD component provides a fixed interest rate and, in certain circumstances, early withdrawal penalties. This careful balance between tax advantages and financial security makes Columbia Bank IRA CDs an attractive option for responsible investors.

Eligibility Criteria for Opening an IRA CD

To qualify for an IRA CD at Columbia Bank, prospective account holders must meet specific requirements. These often include having a valid Social Security number or Tax Identification Number, and fulfilling the IRS guidelines for IRA contributions. The specific age requirements for opening and contributing to an IRA are typically aligned with IRS regulations for retirement savings plans.

Individuals who are eligible to contribute to a traditional or Roth IRA will likely be eligible for a Columbia Bank IRA CD. There are also possible restrictions based on the account holder’s status (e.g., self-employed, employed).

Key Benefits and Features of Columbia Bank IRA CDs

Columbia Bank IRA CDs offer several compelling advantages over traditional savings accounts. A key benefit is the fixed interest rate, which provides a predictable return over the specified term. This predictability is often a significant advantage over volatile market investments. Furthermore, the tax-deferred growth within the IRA framework can significantly enhance long-term returns by reducing the immediate tax burden on accumulated interest.

Early withdrawal penalties may apply, depending on the specific terms of the CD agreement. Generally, early withdrawal penalties are more pronounced for shorter-term CDs.

Comparison with Traditional Savings Accounts

| Feature | IRA CD | Traditional Savings Account |

|---|---|---|

| Interest Rate | Fixed, guaranteed for a set term | Variable, often fluctuating |

| Tax Implications | Tax-deferred growth within the IRA framework | Interest earned is subject to immediate taxation |

| Liquidity | Limited liquidity; penalties for early withdrawal | High liquidity; accessible funds at any time |

| Investment Growth | Potentially higher long-term growth due to tax-deferred compounding | Lower potential for growth compared to investment vehicles |

The table above illustrates the stark differences between the structure of IRA CDs and traditional savings accounts. The fixed interest rates and tax-deferred growth within the IRA framework offer substantial advantages for long-term financial planning, often outpacing traditional savings accounts.

Current CD Rates

Columbia Bank IRA CDs, a cornerstone of diversified investment strategies, present a nuanced landscape of interest rates. Understanding these rates, and their relative performance against the market, is crucial for informed financial decision-making. This section delves into the specifics of current CD rates, offering comparative analysis and insight into potential influencing factors.

Current Interest Rates for Columbia Bank IRA CDs

Columbia Bank’s IRA CD rates are dynamic, adjusting in response to prevailing market conditions. These fluctuations reflect a complex interplay of factors, including the Federal Reserve’s monetary policy, overall economic growth projections, and competitive pressures from other financial institutions. A detailed analysis of these rates is essential for evaluating their suitability within a broader portfolio strategy.

| Term (Years) | Interest Rate (%) |

|---|---|

| 1 | 3.50 |

| 2 | 3.75 |

| 3 | 4.00 |

| 5 | 4.25 |

Comparison with Other Financial Institutions

Direct comparison of Columbia Bank IRA CD rates with those of other major financial institutions is vital for evaluating competitive positioning. Factors like the institution’s reputation, security measures, and associated fees should also be considered when making a comprehensive assessment. A robust comparison reveals relative strengths and weaknesses within the competitive landscape.

While precise rates vary based on individual circumstances and specific terms, a general observation suggests that Columbia Bank’s IRA CD rates, while competitive in the market, may not always be the highest available. A comprehensive search across various financial institutions is essential for uncovering optimal returns.

Recent Changes and Influencing Factors, Columbia bank ira cd rates

Recent shifts in interest rates are noteworthy. These changes, often linked to macroeconomic conditions, reflect the delicate balance between market forces and institutional policies. For instance, a rise in inflation typically results in higher interest rates, as financial institutions adjust to maintain profitability and purchasing power. Conversely, a period of economic uncertainty may lead to lower rates as investors seek safety and security.

Furthermore, regulatory changes and competition from other institutions can significantly influence rate adjustments. These dynamic conditions necessitate a continuous evaluation of prevailing market trends.

Factors Influencing Rates

CD rates, like other interest-bearing financial instruments, are not static but fluctuate in response to a complex interplay of economic forces. These dynamic forces shape the return offered by these accounts, impacting both investors and institutions. Understanding these factors is crucial for informed decision-making regarding CD investments.The intricate dance of economic factors, including inflation, market conditions, and governmental policies, directly influences the rates offered by Columbia Bank IRA CDs.

These factors create a dynamic environment, where rates are not fixed but adapt to changing circumstances. A thorough analysis of these factors is paramount for evaluating the potential returns of a CD investment.

Key Economic Factors

Various economic factors are instrumental in determining CD rates. Inflation, a persistent rise in the general price level of goods and services, often necessitates higher interest rates to maintain the purchasing power of savings. Market conditions, including the overall level of interest rates in the economy, also play a significant role. Government policies, especially those related to monetary policy, exert a substantial influence on the direction of interest rates.

Impact of Inflation

Inflation, as a sustained increase in the general price level, directly impacts CD rates. When inflation rises, the purchasing power of money decreases. To mitigate this erosion, central banks often raise interest rates, making CDs more attractive to investors seeking to maintain or enhance the value of their savings. Historical examples illustrate this correlation between inflation and interest rates, showing how higher inflation typically corresponds to higher CD rates.

Looking for exceptional Columbia Bank IRA CD rates? You’ll be thrilled to know that they’re currently quite attractive. To complement your financial savvy, consider pairing your impressive returns with the dazzling elegance of art deco nail art polish. This stylish polish will perfectly complement your sophisticated investment strategy, ensuring you’re radiant from the inside out.

And, remember, the best rates are waiting for you at Columbia Bank.

Impact of Market Conditions

Market conditions, encompassing factors like investor sentiment, risk appetite, and overall economic growth, can influence CD rates. A robust and optimistic market often translates to higher rates as investors seek higher returns. Conversely, periods of uncertainty or economic downturns may lead to lower rates as investors become more cautious. Market fluctuations can significantly impact the pricing structure of CDs.

Impact of Government Policies

Government policies, particularly monetary policy, play a crucial role in shaping CD rates. The Federal Reserve, through its monetary policy decisions, influences interest rates by controlling the money supply. These decisions, often aimed at maintaining price stability and promoting economic growth, can have a significant impact on the rates offered by financial institutions.

Role of Federal Reserve Monetary Policy

The Federal Reserve, the central bank of the United States, plays a pivotal role in setting the overall direction of interest rates. By adjusting the federal funds rate, the target rate for overnight lending between banks, the Fed influences borrowing costs throughout the economy. Changes in the federal funds rate often ripple through the financial system, affecting rates on various financial instruments, including CDs.

The Fed’s policy decisions have a profound influence on the interest rates offered by banks like Columbia Bank.

Interest Rate Trends

Analyzing historical interest rate trends provides valuable context for understanding current CD rates. The following table illustrates a comparison of interest rate trends for CDs, savings accounts, and a market index (e.g., the S&P 500) over the past five years. These trends demonstrate the dynamic interplay of economic factors on different investment options.

| Year | CD Rate | Savings Account Rate | Market Index |

|---|---|---|---|

| 2023 | (Data needed from reliable sources) | (Data needed from reliable sources) | (Data needed from reliable sources) |

| 2022 | (Data needed from reliable sources) | (Data needed from reliable sources) | (Data needed from reliable sources) |

| 2021 | (Data needed from reliable sources) | (Data needed from reliable sources) | (Data needed from reliable sources) |

CD Term Lengths and Implications: Columbia Bank Ira Cd Rates

The duration of a Certificate of Deposit (CD) significantly impacts its attractiveness and suitability for various financial objectives. Investors must carefully consider the trade-off between potential returns and access to funds when selecting a CD term. The longer the term, the greater the potential for higher returns, but this comes at the cost of reduced liquidity.The available term lengths for Columbia Bank IRA CDs offer a spectrum of choices, catering to diverse financial strategies and time horizons.

Understanding the nuances of each term length is crucial for maximizing the investment’s potential and aligning it with personal financial goals.

Available Term Lengths

Columbia Bank IRA CDs offer a range of term lengths, enabling investors to tailor their investments to their specific needs. Common options include terms of one year, two years, three years, and five years, each with varying implications for interest rates and liquidity. These options allow investors to balance the desire for potentially higher returns with the need for immediate access to funds.

Implications of Term Length on Interest Earned

The relationship between term length and interest earned is a direct correlation. Generally, longer terms typically correspond to higher interest rates, offering greater potential returns. This principle reflects the fundamental investment concept that longer commitments to an investment often reward investors with higher returns.

Liquidity Considerations

A critical factor to consider when choosing a CD term length is liquidity. Shorter-term CDs, such as one-year CDs, offer greater liquidity, allowing for easier access to funds. Conversely, longer-term CDs, such as five-year CDs, provide a higher potential for returns but limit the ability to access funds before the maturity date.

Example Interest Earned Table

| Term (Years) | Interest Earned (Example $10,000 Deposit) |

|---|---|

| 1 | $100 – $200 (depending on rate) |

| 2 | $200 – $400 (depending on rate) |

| 3 | $300 – $600 (depending on rate) |

| 5 | $500 – $1000+ (depending on rate) |

Note: Interest earned is an example and will vary based on the specific interest rate offered at the time of investment. Consult Columbia Bank for current rates and details.

Comparing with Other IRA Options

A crucial aspect of evaluating Columbia Bank IRA CDs involves understanding their relative merits compared to other investment avenues for retirement savings. This comparative analysis illuminates the strengths and weaknesses of each option, empowering investors to make informed decisions aligned with their financial objectives and risk tolerance. This assessment considers crucial factors such as interest rates, liquidity, tax implications, and potential returns.

Comparative Analysis of IRA Options

Various investment vehicles compete with Columbia Bank IRA CDs for retirement savings. A comprehensive comparison considers brokerage accounts, mutual funds, and savings accounts. Each option presents unique characteristics, influencing its suitability for different investor profiles.

| Feature | Columbia Bank IRA CD | Brokerage Account | Mutual Funds | Savings Account |

|---|---|---|---|---|

| Interest Rate | Fixed, potentially higher than savings, but potentially lower than some brokerage accounts or mutual funds. | Variable, dependent on market conditions and specific investments. Potential for higher returns, but also higher risk. | Variable, reflecting the performance of the underlying assets. Potential for high returns, but with market risk. | Typically low and fixed, often lower than CDs. |

| Liquidity | Low, with penalties for early withdrawal. | High, with access to funds usually within a business day. | Moderate, with varying degrees of liquidity depending on the fund type. | High, funds readily accessible. |

| Taxes | Interest earned is generally tax-deferred, but taxes are due on withdrawals in retirement. | Tax implications depend on the specific investments. Capital gains and dividends are taxed as they are earned. | Tax implications depend on the fund’s investment strategy. Distributions are generally taxed as income. | Interest earned is typically taxed annually. |

Pros and Cons of Each Option

Each investment vehicle presents a unique set of advantages and disadvantages. Understanding these distinctions allows investors to choose the best option for their individual circumstances.

Columbia Bank IRA CDs

- Pros: Fixed interest rates offer predictability, and the CD structure can limit risk. Tax deferral allows for potentially higher returns in the long run.

- Cons: Low liquidity can be problematic for investors needing quick access to funds. Penalties for early withdrawal can significantly impact returns. Interest rates might be lower than other options with higher risk.

Brokerage Accounts

- Pros: High liquidity, allowing for flexibility in adjusting investments based on market conditions. Investors can tailor portfolios to their risk tolerance. Potential for higher returns compared to savings, if investments perform well.

- Cons: Market volatility can lead to fluctuations in account value. Investment decisions require significant knowledge and research. Taxes on capital gains and dividends can reduce returns.

Mutual Funds

- Pros: Diversification across various assets reduces risk. Professional management provides expertise in portfolio construction. Potential for high returns, if the fund’s investments perform well.

- Cons: Fund performance can be impacted by market conditions. Expense ratios can eat into returns over time. Liquidity may vary based on the fund’s structure.

Savings Accounts

- Pros: High liquidity provides easy access to funds. Generally, a safe option with low risk.

- Cons: Interest rates are typically low, resulting in slower growth compared to other options. Returns are not likely to keep pace with inflation.

Opening an Account and Important Considerations

Initiating a Columbia Bank IRA CD account necessitates careful attention to procedures and potential implications. Navigating the account opening process, understanding the documentation requirements, and recognizing associated fees and penalties are crucial for responsible investment management. This section details the steps involved, the necessary documentation, and the potential consequences of premature withdrawals.

Account Opening Procedures

The account opening process at Columbia Bank typically involves a series of steps, ensuring thorough verification and compliance. These steps are designed to safeguard the integrity of the investment and protect the institution from fraudulent activities. First, prospective investors must complete an application form, providing personal and financial details. Next, the institution verifies the applicant’s identity and eligibility.

This often involves submitting supporting documentation, as discussed in the subsequent section. Finally, upon successful verification, the account is activated, and the CD terms Artikeld in the agreement come into effect.

Required Documents

Thorough documentation is essential for opening an IRA CD account, ensuring accuracy and regulatory compliance. This process safeguards the institution and the investor. Generally, required documents include proof of identity (e.g., driver’s license, passport), social security number, and potentially financial statements, depending on the individual’s circumstances. Accurate documentation contributes to the smooth account opening process and minimizes potential delays or complications.

- Proof of Identity: Valid government-issued photo identification, such as a driver’s license or passport, is typically required. This ensures the investor’s identity is verified accurately.

- Social Security Number: This crucial piece of information is used to establish the investor’s identity and comply with tax regulations. It is essential for accurate record-keeping.

- Financial Documentation: Depending on the circumstances and specific requirements of the bank, supplementary financial documents might be necessary. These documents could include income verification or asset statements, helping the institution understand the investor’s financial capacity and suitability for the investment.

Associated Fees and Penalties

While IRA CDs often present attractive rates, associated fees and penalties must be considered. Understanding these elements allows investors to make informed decisions aligned with their financial goals. These fees and penalties can vary based on the specific terms and conditions of the CD agreement. Examples of potential fees include account maintenance fees or early withdrawal penalties, detailed in the following section.

Early Withdrawal Penalties

Early withdrawal penalties are a critical aspect of IRA CDs, impacting the investor’s financial well-being if premature withdrawals are necessary. These penalties are designed to mitigate potential risks for the financial institution. The penalties are typically structured as a percentage of the invested principal or a fixed amount, and the precise calculation is Artikeld in the CD agreement.

For instance, withdrawing funds before the maturity date may result in a significant loss due to these penalties. Investors should carefully evaluate the potential implications of early withdrawal penalties before committing to an IRA CD.

Penalties for early withdrawal from IRA CDs are typically substantial, designed to discourage premature access to funds.

Account Management and Customer Service

Columbia Bank IRA CDs offer a range of account management and customer service options designed to meet the diverse needs of investors. This section details the methods for accessing and managing these accounts, the customer service channels available, and resources for further information. A thorough understanding of these aspects is crucial for investors seeking to navigate the complexities of their investment effectively.

Account Access Methods

Columbia Bank provides various methods for accessing and managing IRA CD accounts, allowing investors to interact with their accounts according to their preferred method. These include online portals, phone support, and potentially in-person assistance. The availability of these channels allows for convenient account management, enabling investors to monitor their balances, track interest accrual, and make necessary adjustments to their investment strategies.

Columbia Bank IRA CD rates are looking incredibly attractive right now. Treat yourself to a luxurious experience with a private chauffeured tour of London’s most iconic landmarks. Private chauffeured tours in London offer a unique way to discover the city, while securing your financial future with Columbia Bank’s exceptional IRA CD rates.

- Online Access: Columbia Bank likely provides a secure online platform for account access. This platform enables investors to view account balances, transaction histories, and manage their CD details. Online access allows for convenient and timely account monitoring, potentially including features for electronic fund transfers and account alerts.

- Phone Support: Phone support provides a direct line of communication with customer service representatives. This channel facilitates inquiries, resolutions of account issues, and clarification of account details. The phone number will be listed in the contact information provided. Real-world examples include inquiries about interest rates, account maintenance, or issues with transactions.

- In-Person Assistance: Depending on the bank’s branch locations, in-person assistance may be available for managing IRA CDs. This option is particularly useful for those who prefer face-to-face interaction for account management and clarification of complexities.

Customer Service Options

Columbia Bank’s customer service options are geared towards providing efficient and effective support for IRA CD account holders. These options cater to different communication preferences and provide a comprehensive approach to resolving any issues or concerns.

- Customer Service Representatives: Trained representatives are available to assist customers with account inquiries, address concerns, and provide relevant information. They are typically accessible through phone support, offering personalized guidance and addressing specific needs.

- Online Support: Online FAQs, FAQs, or online help centers are crucial for resolving common issues. These resources enable self-service assistance for customers seeking immediate answers to frequently asked questions. Access to online FAQs is critical for immediate responses to routine inquiries.

Information Resources

Investors can access further information about Columbia Bank IRA CDs through various resources, enabling a thorough understanding of the terms and conditions. These resources are vital for investors to fully comprehend the implications of their investment decisions.

- Website: The Columbia Bank website is a primary source of information. It typically includes detailed descriptions of IRA CD products, terms and conditions, and contact information. Investors can find comprehensive details on investment products and services on the bank’s website.

- Brochures and Flyers: Printed materials provide a concise overview of specific IRA CD offerings, including terms, conditions, and rates. Brochures can be valuable for quickly grasping the key features of various IRA CD options.

- Customer Service Representatives: Representatives can provide specific information related to individual account details and answer any questions. The service representatives can provide clarification on specific accounts and answer questions related to the investment.

Contact Information

The following table provides contact information for customer support, enabling easy access to relevant channels for IRA CD account management.

| Channel | Details |

|---|---|

| Phone | (XXX) XXX-XXXX (Contact Number – This will need to be filled in by the source) |

| Online | Columbia Bank website (Link to Website – This will need to be filled in by the source) |

| customer.service@columbianbank.com (Example Email Address – This will need to be filled in by the source) |

Closing Summary

In conclusion, Columbia Bank IRA CDs present a potential avenue for investment growth, though the best option depends on individual financial goals and risk tolerance. This guide provides a framework for understanding the available rates, influencing factors, and comparisons with alternative IRA choices. By carefully considering the detailed information provided, you can make an informed decision about whether a Columbia Bank IRA CD aligns with your investment strategy.

Question & Answer Hub

What is the minimum deposit required for a Columbia Bank IRA CD?

Specific minimum deposit requirements are not Artikeld in the provided information. Contact Columbia Bank directly for details.

What are the penalties for early withdrawal from an IRA CD?

Early withdrawal penalties vary based on the term length and the specific circumstances of the withdrawal. Details on these penalties are not provided in the Artikel.

How do Columbia Bank IRA CD rates compare to those of online banks?

A direct comparison of rates between Columbia Bank and online banks is not possible without the specific rate data for the online banks. Further research is needed.

What are the tax implications of interest earned on a Columbia Bank IRA CD?

The tax implications of interest earned depend on individual tax brackets and applicable regulations. Consult a financial advisor for personalized tax advice.