B recently died and was insured, triggering a complex process for beneficiaries. This guide delves into the essential steps, from initiating the claim to understanding the financial implications and ethical considerations. We’ll explore the nuances of policy terms, potential challenges, and the crucial role of the insurance company and beneficiaries throughout this process.

This comprehensive overview provides a step-by-step approach to navigating the intricacies of a life insurance claim. It covers critical aspects like policy terms and conditions, potential challenges beneficiaries may face, and the financial impact of the death benefit. The guide also considers the insurance company’s perspective and the responsibilities of the beneficiary. Ethical considerations are explored to ensure a thorough understanding of the process.

Processing the Claim

Initiating a life insurance claim after a death necessitates a structured approach to ensure a smooth and efficient process. This involves a series of steps, meticulous documentation, and a defined timeframe. Understanding these procedures is crucial for beneficiaries to receive the benefits rightfully due to them.The process of processing a life insurance claim is governed by specific rules and regulations.

These rules are designed to protect both the policyholder and the insurance company, and ensure that claims are handled fairly and accurately. Compliance with these procedures is essential for a timely resolution.

Claim Initiation Procedure

A well-defined procedure for initiating a life insurance claim is essential for a smooth process. This procedure typically involves several steps, beginning with immediate notification.

- Notification: The beneficiary or designated claimant must immediately notify the insurance company of the death. This notification should include the policyholder’s name, policy number, and contact information for the claimant. Immediate notification prevents potential delays and allows the insurance company to initiate the claim process promptly.

- Claim Form Submission: The insurance company will provide a claim form that must be completed and submitted. This form will require details about the deceased, the policy, and the claimant. Accuracy and completeness in the form submission are critical for avoiding delays.

- Supporting Documents Submission: A comprehensive set of supporting documents is usually required. These documents vary depending on the specific policy and the insurance company’s requirements.

Required Documentation

The specific documentation required for a life insurance claim can vary. However, there are common documents required across many policies.

- Death Certificate: This is a legally required document that confirms the death of the insured person. It contains crucial information such as the cause of death and date of death.

- Policy Documents: The original or certified copies of the life insurance policy, including the application, endorsements, and any relevant amendments, are needed.

- Proof of Beneficiary Designation: Documentation proving the claimant’s status as a beneficiary, such as a copy of the will or trust documents.

- Claim Form: A completed and signed claim form, containing accurate and complete information about the deceased, the policy, and the claimant.

- Other Documents: Depending on the circumstances, additional documentation might be required, such as medical records, tax returns, or other financial documents, as specified by the insurance company.

Typical Claim Processing Timeframe

The timeframe for processing a life insurance claim varies significantly. It depends on factors like the complexity of the claim, the completeness of the submitted documentation, and the insurance company’s internal processes.

- Standard Timeframe: The typical timeframe for processing a straightforward claim, with complete documentation, ranges from 45 to 60 days. This is a general estimate, and actual processing times may vary.

- Complex Claims: More complex claims, involving disputes, investigations, or extensive documentation, can take significantly longer. These cases might extend to several months.

Life Insurance Policy Claim Procedures

Different types of life insurance policies may have varying claim procedures.

| Policy Type | Claim Procedure |

|---|---|

| Term Life Insurance | Generally straightforward, with claims processed based on policy terms and death certificates. |

| Whole Life Insurance | Procedures may involve additional steps related to policy cash value or other policy features. |

| Universal Life Insurance | Claim procedures are often similar to whole life policies, but may involve additional steps based on policy specifics. |

| Variable Life Insurance | Claim procedures can be more complex due to investment components, requiring clarification of policy details. |

Policy Terms and Conditions

Thorough review of life insurance policy terms and conditions is crucial for beneficiaries and policyholders. Understanding the specifics of the policy ensures a smooth claim process and avoids potential disputes. This section details critical aspects of life insurance policies, encompassing exclusions, limitations, and factors affecting claim settlements.Policy terms and conditions are legally binding agreements between the insurance company and the policyholder.

These documents Artikel the responsibilities of both parties, the coverage provided, and the circumstances under which the policy may not apply. Careful consideration of these stipulations is vital for navigating the claim process effectively.

Importance of Reviewing Policy Terms and Conditions

Understanding the policy’s terms and conditions is essential to anticipate potential issues during the claim process. This proactive approach allows policyholders and beneficiaries to recognize potential exclusions or limitations that might affect the claim amount.

Common Exclusions and Limitations in Life Insurance Policies

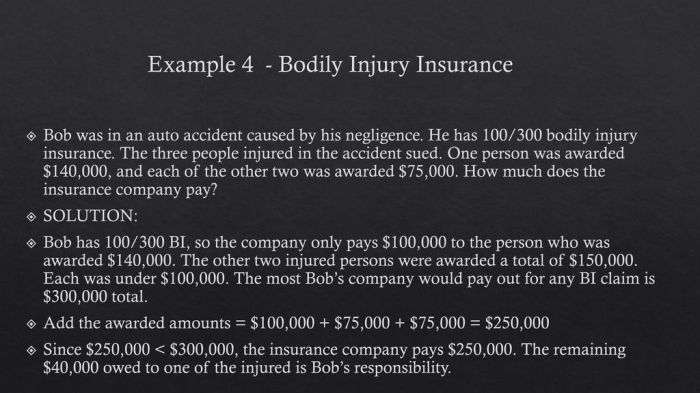

Life insurance policies often contain exclusions and limitations to define the scope of coverage. These provisions specify situations where the policy will not pay out a death benefit. Common exclusions include death caused by war, suicide within a specific timeframe (typically a few years), or certain pre-existing conditions. A thorough review of the policy document will identify specific limitations.

Factors Influencing the Claim Settlement Amount

Several factors can impact the final claim settlement amount. These include the policy’s face value, the death benefit, any applicable riders, and any outstanding premiums. The presence of outstanding premiums will usually reduce the settlement amount.

Role of Beneficiaries in the Claim Process

Beneficiaries play a critical role in the claim process. They are designated individuals who will receive the death benefit. Beneficiary designations must comply with the policy’s stipulations, and the correct procedure for filing a claim must be followed. A beneficiary’s failure to comply with these requirements can cause delays or rejection of the claim.

Comparison of Policy Riders and Their Impact on Claims, B recently died and was insured

| Rider | Description | Impact on Claim |

|---|---|---|

| Accidental Death Benefit Rider | Provides an additional death benefit if the death is accidental. | Increases the total claim amount if the death is accidental. |

| Critical Illness Rider | Provides a lump-sum payment if the policyholder is diagnosed with a critical illness. | This rider does not directly impact the death benefit claim but offers a separate payout. |

| Waiver of Premium Rider | Waives future premium payments if the policyholder becomes disabled. | Can reduce the financial burden on beneficiaries in case of disability. |

| Return of Premium Rider | Provides a portion of the premiums paid back to the beneficiary if the policy lapses or is surrendered before a certain time. | Can increase the payout amount depending on the specific conditions of the rider. |

This table illustrates common policy riders and their potential impact on the claim settlement amount. Reviewing these riders is essential to understand the full extent of the coverage provided. It is important to note that specific terms and conditions within each rider may vary significantly.

Potential Challenges

Beneficiaries navigating life insurance claims often encounter various obstacles. These challenges can range from administrative complexities to legal disputes, significantly impacting the claim process and the timely receipt of benefits. Understanding these potential difficulties is crucial for beneficiaries to proactively address them and safeguard their rights.The complexities of life insurance claims often lead to delays, disputes, and denial.

Careful attention to policy terms, documentation requirements, and potential legal avenues can mitigate these risks and streamline the claim process. A proactive approach to these issues can lead to a more efficient and less stressful experience for the beneficiary.

Common Issues Faced by Beneficiaries

Beneficiaries may experience difficulties in assembling required documentation, understanding policy terms, or navigating the claim process itself. These difficulties can range from simple errors in documentation to more complex legal disputes. Misunderstandings about policy provisions, conflicting accounts from witnesses, or missing vital records can create obstacles in the claim. In addition, beneficiaries might encounter difficulties in communicating with the insurance company regarding the status of their claim.

Typical Reasons for Claim Denial

Life insurance claims can be denied for various reasons. Non-compliance with policy provisions is a frequent cause. This includes failure to meet specific requirements for coverage, such as providing timely notifications or maintaining premium payments. Inaccurate or incomplete applications or insufficient documentation can also lead to claim denial. Furthermore, fraudulent activities, such as misrepresenting the insured’s health or circumstances, can result in the denial of a claim.

Finally, claims exceeding policy limits or failing to comply with specific clauses in the policy terms and conditions will often result in claim denial.

Dispute Resolution Methods

Beneficiaries facing claim denial or experiencing delays have several dispute resolution options. Mediation involves a neutral third party assisting in reaching a mutually agreeable solution. Arbitration involves a neutral third party making a binding decision. Litigation, as a last resort, involves presenting the case in court. Each method offers varying degrees of formality and cost, with the most suitable option depending on the specific circumstances and the claimant’s resources.

Understanding the nuances of each process is crucial for beneficiaries to make informed decisions.

Legal Considerations in Life Insurance Claims

Legal considerations in life insurance claims are significant. Statutes of limitations on claims can vary, impacting the time frame within which a beneficiary can pursue a claim. Understanding these limitations is critical for beneficiaries to ensure their rights are protected. Contract law principles are crucial in determining the validity and enforceability of the policy terms and conditions.

Specific legal counsel is often necessary to navigate these intricacies and ensure that beneficiaries understand their rights and responsibilities.

Common Reasons for Claim Delays

| Reason for Delay | Explanation |

|---|---|

| Incomplete Documentation | Missing or inaccurate information from the beneficiary or the insured can significantly delay the claim processing. |

| Verification Processes | Insurance companies often require extensive verification of the insured’s identity, death certificate, and beneficiary details, which can take time. |

| Policy Review | The insurance company must thoroughly review the policy terms and conditions to determine if the claim meets the criteria for coverage. |

| External Investigations | If the death is suspicious or if there are conflicts of interest, the insurance company may require further investigations by external parties, adding to the processing time. |

| Financial Transactions | Processing of payments, fund transfers, and beneficiary identification can take time, depending on the complexity and specifics of each transaction. |

Financial Implications

The death of a loved one brings significant financial adjustments for the beneficiary. Life insurance proceeds provide a crucial financial cushion during this challenging time, impacting the beneficiary’s immediate and long-term financial well-being. This section examines the multifaceted financial implications of receiving life insurance benefits.

Impact on the Beneficiary

The life insurance death benefit serves as a crucial financial resource for the beneficiary, mitigating potential financial hardships. This benefit can provide funds for immediate needs, such as funeral expenses and outstanding debts, and support future financial obligations. The size of the benefit significantly influences the extent of this impact, enabling the beneficiary to adapt to the sudden loss of income and meet various financial responsibilities.

Uses of Death Benefit

The death benefit is a flexible resource, allowing for various applications. Common uses include covering funeral expenses, settling outstanding debts, and providing a financial safety net for surviving dependents. These funds can also be used to fund education, support ongoing living expenses, or invest for the future.

Budgeting for Immediate Needs

Careful budgeting is essential to manage immediate financial needs after a death. Funeral expenses, including burial arrangements, memorial services, and related costs, often represent a significant portion of the immediate financial burden. Other immediate needs may include outstanding debts, unpaid bills, and essential living expenses for surviving dependents. A detailed breakdown of anticipated expenses is crucial to ensure adequate funding and avoid financial strain.

A sample budget could include:

- Funeral Expenses: Estimate costs for services, embalming, viewing, burial plot, etc. Research local funeral homes for pricing information.

- Outstanding Debts: Compile a list of outstanding loans, credit card balances, and other debts. Calculate the total amount and prioritize payment based on terms and interest rates.

- Essential Living Expenses: Estimate the ongoing costs for housing, utilities, food, and other necessities for surviving dependents. Consider long-term care needs if applicable.

Allocating Funds for Future Obligations

The life insurance proceeds can be strategically allocated to meet future financial obligations. These include educational expenses for children, retirement savings for the surviving spouse, or investments to secure future income streams. Careful planning and investment strategies can maximize the long-term value of the funds.

Tax Implications of Life Insurance Benefits

The tax treatment of life insurance benefits varies depending on the beneficiary’s relationship to the insured. In many jurisdictions, death benefits are generally exempt from federal income tax for beneficiaries. However, it is crucial to consult a tax advisor to determine the specific tax implications based on individual circumstances and local laws. The tax implications of life insurance benefits can be complex and should be discussed with a qualified professional.

Investment Options for Death Benefit

A variety of investment options are available to maximize the value of life insurance proceeds. These options may include:

| Investment Option | Description | Potential Return | Risk Level |

|---|---|---|---|

| Certificates of Deposit (CDs) | Fixed-income investments with guaranteed returns. | Low to moderate | Low |

| Money Market Accounts | Accounts that offer higher interest rates than standard savings accounts. | Low | Low |

| Bonds | Debt securities issued by corporations or governments. | Moderate | Moderate |

| Stocks | Represent ownership in a company. | High | High |

| Mutual Funds | Invest in a diversified portfolio of stocks, bonds, or other assets. | Variable | Moderate |

Investment decisions should align with the beneficiary’s risk tolerance and financial goals. Carefully consider the potential risks and rewards of each option before making investment choices.

Insurance Company Practices

Insurance companies employ standardized procedures to process claims, aiming for efficiency and fairness. These practices, while often complex, are designed to ensure that valid claims are settled promptly and fairly. Understanding these practices is crucial for beneficiaries navigating the claims process.Insurance companies often have internal policies and procedures that dictate how claims are handled. These policies typically Artikel the steps required for a claim to be processed, from initial notification to final settlement.

Furthermore, these procedures often incorporate provisions for handling complex or disputed claims, ensuring that all parties are treated fairly and equitably.

Common Claims Handling Practices

Insurance companies typically follow a standardized process for handling claims. This often involves an initial assessment of the claim, verification of policy terms and conditions, and an investigation into the circumstances surrounding the claim. This initial stage may include reviewing supporting documentation, such as medical records or accident reports. After the initial assessment, the company might engage an adjuster to further evaluate the claim’s validity and potential costs.

- Claims are typically assessed for validity and compliance with policy terms. This includes verifying the insured’s eligibility, the cause of the claim, and if the claim is covered by the policy.

- Insurance adjusters play a critical role in assessing the claim’s validity and determining the appropriate amount of compensation. This role involves investigating the claim, reviewing relevant documents, and determining the extent of damages or losses.

- Communication between the beneficiary and the insurance company is vital for a smooth claim resolution process. Clear and timely communication helps ensure that both parties are informed about the claim’s status and any necessary actions.

Handling Complex or Disputed Claims

Insurance companies employ various strategies to handle complex or disputed claims. This might involve independent appraisals or expert opinions to resolve disagreements. Mediation or arbitration may also be employed to facilitate a mutually agreeable settlement. The goal in these cases is to reach a fair resolution that adheres to policy terms and legal requirements.

- In cases where the cause of the claim is disputed, the insurance company may commission independent investigations or engage experts to provide a second opinion on the facts. This can involve engineers, appraisers, or medical professionals.

- Mediation or arbitration is often used to resolve disputes. A neutral third party facilitates communication between the parties involved, aiming to reach a mutually agreeable settlement.

Comparison of Insurance Company Approaches

Different insurance companies may have varying approaches to claim settlement, often influenced by their internal policies and procedures. Some companies might be more responsive and proactive in their communication, while others may take a more cautious approach. Variations in claim settlement timelines may also exist, reflecting the complexities of individual claims and the resources available to each company.

Such differences can affect the time it takes to resolve a claim, potentially influencing the financial implications for the beneficiary.

Role of the Insurance Adjuster

Insurance adjusters play a vital role in the claim process. They are responsible for investigating the claim, evaluating damages, and negotiating a settlement. Their expertise and experience are essential in ensuring that claims are handled fairly and efficiently.

- Adjusters gather information from various sources, including witnesses, medical professionals, and other relevant parties, to assess the claim’s validity and extent of damages.

- Adjusters assess damages and losses, determining the appropriate compensation based on policy terms and conditions. This may involve inspecting property damage, evaluating medical expenses, or determining lost income.

- Negotiation skills are critical for adjusters. They strive to reach a fair settlement that satisfies both the policyholder and the insurance company. This often involves compromise and a balanced approach to claim resolution.

Importance of Communication

Open and timely communication between the beneficiary and the insurance company is crucial for a smooth and efficient claim resolution process. Beneficiaries should promptly provide all necessary documentation and maintain regular contact with the insurance company to stay informed about the claim’s status. Maintaining clear communication channels can help avoid misunderstandings and expedite the claims process.

Claim Settlement Timelines

| Insurance Company | Average Claim Settlement Time (Days) | Notes |

|---|---|---|

| Company A | 30-45 | Known for quick turnaround in uncomplicated claims |

| Company B | 45-60 | Often handles more complex claims, requiring thorough investigation |

| Company C | 60-90 | Focuses on high-value claims, requiring comprehensive assessment |

Note: These are illustrative figures and actual timelines may vary depending on the complexity of the claim and the specific circumstances.

Beneficiary Responsibilities

Beneficiaries play a crucial role in the claim process following the death of an insured individual. Their responsibilities extend beyond simply receiving the payout and encompass a range of actions that ensure a smooth and efficient claim settlement. Accurate information and timely action are essential to expedite the process.Beneficiaries have specific obligations in the insurance claim process. These obligations are vital for the accurate and efficient processing of the claim.

Adherence to these responsibilities ultimately benefits all parties involved.

Providing Accurate Information

Beneficiaries are expected to furnish accurate and complete information to the insurance company. This includes details about the deceased insured, the policy terms, and the beneficiary’s own identity and relationship to the insured. Inaccurate or incomplete information can delay or even deny the claim. Examples include providing incorrect dates of birth, policy numbers, or beneficiary designations.

Role of Beneficiary Designation

The beneficiary designation is a critical aspect of the policy. It legally specifies who will receive the insurance proceeds. Beneficiaries must ensure the designation accurately reflects their intentions. Any changes to the beneficiary designation should be documented and processed through the insurance company to ensure the updated designation is effective. The failure to update the beneficiary designation could lead to unexpected outcomes.

Verifying Policy Validity

Beneficiaries must verify the validity of the insurance policy. This entails confirming the policy’s existence, coverage amount, and outstanding premiums. This step helps avoid potential disputes or delays in the claim process. Reviewing the policy documents, especially the policy terms and conditions, is crucial.

Preparing for Potential Claim Questions

Beneficiaries should anticipate potential questions from the insurance company. They should gather supporting documents, such as the death certificate, proof of relationship to the insured, and any relevant financial records. Examples of questions include the relationship between the beneficiary and the deceased, the date of death, and the reason for death. Thorough preparation can significantly reduce potential delays in the claim process.

B recently passed away and was insured, which is good news for the family. They’ll likely need a place to live, and with B’s passing, there are now houses for sale in Temple, Calgary here. Hopefully, this will help them find a suitable home quickly and navigate this difficult time.

Having readily available documentation can expedite the claim process.

Types of Beneficiary Designations

Understanding the different types of beneficiary designations can help beneficiaries ensure their choices align with their intentions. These designations dictate the distribution of insurance proceeds.

| Type of Designation | Description |

|---|---|

| Single Beneficiary | A single individual or entity is named as the sole recipient of the insurance proceeds. |

| Joint Beneficiaries | Two or more individuals or entities are named to share the proceeds. The policy may specify how the proceeds are divided. |

| Contingent Beneficiary | A secondary beneficiary is named to receive the proceeds if the primary beneficiary is deceased or unable to receive the funds. |

| Class Beneficiary | A group of individuals, such as children or siblings, are named as beneficiaries. The policy often specifies how the proceeds are distributed within the class. |

| Trust Beneficiary | A trust is named as the beneficiary, and the proceeds are held and distributed according to the terms of the trust agreement. |

Ethical Considerations

Life insurance claims, while often routine, present unique ethical challenges. Maintaining transparency, impartiality, and a high standard of conduct are paramount in ensuring fairness and trust within the insurance industry. Ethical dilemmas arise when the integrity of the claim process is compromised, impacting the rights of both the policyholder and the beneficiaries.Navigating these complexities requires careful consideration of potential conflicts of interest, the importance of safeguarding sensitive information, and the proper handling of suspected fraud.

The application of ethical principles is crucial in building and maintaining public confidence in the life insurance sector.

Ethical Dilemmas in Life Insurance Claims

The handling of life insurance claims involves a delicate balance of legal and ethical obligations. Cases involving suspected fraud, misrepresentation, or questionable circumstances require careful investigation and adherence to established procedures. These dilemmas often arise when the facts surrounding the death of the insured are unclear or when there are conflicting accounts of events. Insurance companies must act with prudence and impartiality to protect their own interests while upholding the rights of beneficiaries.

Examples of Suspected Fraud or Misrepresentation

Several scenarios can raise suspicion of fraud or misrepresentation in life insurance claims. One example involves a claim where the cause of death is disputed. If evidence suggests the death may have been accidental or suspicious, further investigation is warranted. Another example arises when there’s a discrepancy between the information provided by the beneficiary and the available evidence.

B recently passed away, and thankfully, we had insurance. Now, we’re looking at ways to honour B’s memory, and that includes finding the best nutrition for the next furry friend in our lives. We’ve been looking into diamond extreme athlete dog food – it seems like a great option for an active dog. Ultimately, the insurance payout will help us give the new dog the best start, just like we did with B.

For instance, if the beneficiary’s story changes significantly from initial statements to subsequent interviews, it could signal potential misrepresentation. Finally, claims where the insured’s health was misrepresented on the policy application are another area of concern.

Best Practices for Handling Sensitive Information

Maintaining the confidentiality and integrity of sensitive information is paramount in life insurance claims. All interactions related to a claim should be documented meticulously. Strict adherence to internal policies and procedures is essential to prevent unauthorized access or disclosure of private information. Implementing secure data storage systems and restricting access to relevant personnel is crucial. The utmost discretion and confidentiality should be exercised in handling documents, communications, and any other data related to the claim.

Role of Professional Advisors in Complex Cases

In cases involving intricate circumstances, the role of professional advisors becomes significant. Experts like forensic accountants, medical examiners, and legal counsel can provide critical insights and guidance. These advisors can help assess the validity of claims, identify potential inconsistencies, and ensure that all relevant evidence is considered. Their expertise helps in navigating the complexities of the claim process, providing objectivity and accuracy in investigations.

Potential Conflicts of Interest in the Claim Process

Potential conflicts of interest may arise when individuals or entities involved in the claim process have personal interests that could influence their decisions. For instance, if a claims adjuster has a pre-existing relationship with the beneficiary, it could compromise their impartiality. Similarly, a conflict could exist if an investigator has a financial stake in the outcome of the claim.

The insurance company should have established procedures to identify and mitigate these potential conflicts.

Importance of Transparency in Handling Claims

Transparency is essential in building trust and maintaining public confidence. Clear communication with beneficiaries regarding the status of their claim, the evidence being considered, and the timeline for resolution is crucial. Maintaining open communication channels allows for prompt responses to inquiries and facilitates a smooth claim process. Detailed explanations and justifications for decisions are vital to ensure that beneficiaries understand the rationale behind the outcome.

Providing regular updates on the claim’s progress, outlining the reasons for delays, and explaining any adjustments to the process is a crucial aspect of maintaining transparency.

Illustrations of Different Scenarios

A thorough understanding of life insurance claim processes necessitates the examination of diverse scenarios. This section details various situations, from successful claims to those encountering complexities, to highlight the multifaceted nature of claim handling. Each case underscores the importance of comprehending policy terms, beneficiary designations, and potential challenges.

Successful Life Insurance Claim Scenario

A policyholder, Mr. Smith, passed away after a prolonged illness. His death certificate and supporting medical documentation were promptly submitted to the insurance company. The claim was processed efficiently within the stipulated timeframe. The beneficiary, Mrs.

Smith, received the full death benefit amount, minus applicable taxes and administrative fees, as Artikeld in the policy’s terms and conditions. This successful claim underscores the importance of meticulous documentation and adherence to policy procedures.

Claim Denial and Subsequent Appeal Process

Ms. Jones submitted a claim for her deceased husband’s life insurance policy. The claim was denied due to misrepresentation of pre-existing medical conditions on the application form. Ms. Jones appealed the decision, providing additional medical records and clarifying the nature of the pre-existing conditions.

Following a thorough review, the insurance company reversed the denial, recognizing the accuracy of the clarified information. This scenario emphasizes the significance of accurate information during the application process and the validity of appeals.

Policy Terms and Conditions Not Properly Understood

Mr. Brown’s policy included a clause regarding the waiting period for a claim. Due to a misunderstanding of this clause, the claim was initially submitted prematurely. Consequently, the claim was delayed. Subsequently, Mr.

Brown’s beneficiary contacted the insurance company, seeking clarification on the waiting period. This instance highlights the necessity of thoroughly reviewing policy documents to avoid errors and ensure compliance with terms and conditions.

Beneficiary Seeking Legal Assistance

Mrs. Garcia, a beneficiary, encountered difficulties in navigating the complex claim process. She lacked the necessary legal expertise to understand the nuances of the policy’s provisions and the applicable laws. Consequently, she engaged legal counsel to represent her interests. This case illustrates the potential for beneficiaries to seek professional guidance to ensure their rights are protected during a claim.

Multiple Life Insurance Policies

Mr. Lee held multiple life insurance policies with different insurers. Upon his death, his beneficiaries faced the task of navigating claims with multiple insurance companies. Coordination of the claims and the receipt of all benefits were necessary to ensure comprehensive settlement. This situation underscores the complexity that can arise when dealing with multiple policies.

Complex Beneficiary Designation

A complex beneficiary designation involved a deceased individual with multiple children and a complicated family history. The policy’s beneficiary form did not clearly specify the intended recipients. The insurance company’s involvement in clarifying the beneficiaries and confirming the intended distribution highlights the importance of unambiguous beneficiary designations to avoid disputes and delays in processing the claim.

Final Conclusion: B Recently Died And Was Insured

In conclusion, navigating the aftermath of a death and the associated life insurance claim requires careful attention to detail. Understanding the policy terms, the roles of all parties involved, and the potential challenges are crucial. This guide has provided a structured approach to understanding the complexities of the claim process, from claim initiation to financial implications and ethical considerations.

By familiarizing themselves with the information presented, beneficiaries can effectively manage this challenging time.

Essential Questionnaire

What documents are typically required for a life insurance claim?

The required documents vary depending on the insurance policy but usually include the death certificate, the insurance policy itself, proof of beneficiary designation, and any supporting documentation requested by the insurance company.

How long does the claim process typically take?

The timeframe for processing a life insurance claim can vary significantly depending on the complexity of the case, the insurance company’s procedures, and any potential disputes. It can range from a few weeks to several months.

What are some common reasons for a claim denial?

Common reasons for claim denial include insufficient or inaccurate documentation, failure to meet policy requirements, or suspected fraud. Reviewing the policy terms carefully is crucial to avoid potential issues.

What are my responsibilities as a beneficiary in the claim process?

Beneficiaries must provide accurate information, maintain communication with the insurance company, and comply with all policy terms and conditions throughout the claim process.