Does the False Claims Act apply to commercial insurance? This deep dive explores the complex legal landscape surrounding insurance companies and their interactions with government programs. We’ll dissect the nuances of the False Claims Act (FCA), examining its applicability to various commercial insurance products and highlighting potential violations.

From policy misrepresentations to fraudulent claims handling, this analysis will explore the critical elements of FCA liability in the commercial insurance sector. We’ll also touch on government programs like Medicare and Medicaid, and how insurers might inadvertently or intentionally violate the FCA by interacting with these programs.

Scope of the False Claims Act: Does The False Claims Act Apply To Commercial Insurance

The False Claims Act (FCA) is a crucial piece of legislation designed to protect the federal government from fraudulent activities. It empowers individuals, known as whistleblowers, to bring lawsuits against those who submit false claims for payment to the government. This often involves individuals or companies seeking to defraud government programs. Understanding the scope of the FCA is essential for navigating the complex landscape of government contracting and financial dealings.The FCA is a powerful tool for combating fraud, offering a substantial incentive for individuals to come forward with evidence of wrongdoing.

The act’s reach extends far beyond the initial submission of a false claim, encompassing various stages of the process.

False Claims Act: A Concise Overview

The False Claims Act (FCA) is a federal law that prohibits the submission of false claims to the United States government. This encompasses a wide range of activities, including the presentation of inaccurate invoices, inflated pricing, or misleading representations related to products or services provided to the government. The act allows individuals who uncover such fraud to bring a lawsuit on behalf of the government.

Types of Claims Covered by the FCA

The FCA covers a vast array of claims, extending beyond simple financial transactions. The act encompasses any fraudulent activity that results in the government paying for goods or services that are either substandard, non-existent, or falsely represented. This includes, but is not limited to:

- Contractual Misrepresentation: A company might submit a contract proposal with false information about their qualifications, experience, or capability to perform the required services. The government, relying on this misrepresentation, might award a contract, leading to a false claim.

- Billing Fraud: Companies might submit inflated or fraudulent invoices for work not performed or for goods not delivered. This practice is prevalent in government contracts.

- Product or Service Misrepresentation: Companies could provide substandard or defective goods or services, then submit claims for full payment. The government suffers a financial loss due to the false claim of quality.

- Kickbacks and Bribery: Individuals or companies might offer or accept bribes to influence the award of a government contract. This constitutes a false claim, as the contract was not awarded fairly.

Key Elements Required for a Claim Under the FCA

For a claim under the FCA to be successful, several crucial elements must be present. These elements include:

- A false claim: The claim must be demonstrably false or fraudulent.

- Materiality: The false claim must be significant enough to influence the government’s decision-making process. A minor error might not meet this threshold.

- Intent to defraud: The individual or company must have intended to deceive the government in submitting the false claim.

- Loss to the government: The government must have suffered a financial loss due to the fraudulent claim.

Comparison with Other Relevant Laws

The following table compares and contrasts the False Claims Act (FCA) with other relevant legal frameworks:

| Law | Focus | Scope | Remedies |

|---|---|---|---|

| False Claims Act (FCA) | Fraudulent claims against the federal government | Broad, encompassing various forms of fraud | Monetary penalties, civil and criminal penalties |

| Racketeer Influenced and Corrupt Organizations Act (RICO) | Organized criminal activity | Focuses on patterns of criminal activity | Civil and criminal penalties, asset forfeiture |

| State Consumer Protection Laws | Protecting consumers from unfair and deceptive practices | Varies by state, often targets specific business practices | Civil penalties, injunctions, restitution |

Examples of Actionable False Claims Under the FCA

The following table provides illustrative examples of actionable false claims under the FCA:

| Example | Type of False Claim | Explanation |

|---|---|---|

| Inflated invoices for services not rendered | Billing Fraud | A contractor submits inflated invoices for services not completed or for services that are not the scope of the contract. |

| Providing substandard materials | Product Misrepresentation | A supplier provides materials that do not meet the specifications Artikeld in the contract, leading to a loss for the government. |

| Falsely claiming qualifications | Contractual Misrepresentation | A contractor falsely represents their qualifications and experience to secure a contract, resulting in a false claim to the government. |

| Bribery to influence contract award | Kickbacks and Bribery | Offering or accepting bribes to influence the award of a government contract constitutes a fraudulent claim. |

Commercial Insurance and the FCA

Commercial insurance, a multifaceted sector encompassing various protective policies, is a significant target for scrutiny under the False Claims Act (FCA). Understanding how the FCA applies to this industry requires a clear definition of “commercial insurance” within the legal framework. This examination will delve into the different types of commercial insurance products, the implications of misrepresentations or omissions in policies, and potential scenarios where insurers might face FCA liability.

Defining Commercial Insurance

Commercial insurance, for FCA purposes, encompasses policies designed to protect businesses and organizations against financial losses stemming from various risks. This broad category encompasses a spectrum of products tailored to specific business needs and industry sectors.

Types of Commercial Insurance Products

A range of insurance products caters to the diverse needs of businesses. These include, but are not limited to:

- Property Insurance: Policies covering physical assets like buildings, equipment, and inventory against damage or destruction due to events like fire, storms, or vandalism. The policy details must accurately reflect the insured property’s value and characteristics.

- Liability Insurance: Protecting businesses from claims arising from accidents or incidents where the business is held responsible. Examples include general liability, professional liability (errors and omissions), and product liability policies. Accurate representations of potential liabilities are critical.

- Health Insurance: While often associated with individuals, commercial health insurance plans for employees are also subject to FCA scrutiny. Accurate representation of benefits and coverage amounts are vital.

- Workers’ Compensation Insurance: Policies safeguarding employers against financial obligations related to employee injuries or illnesses sustained in the course of employment. Accurate reporting of workplace hazards and insurance coverage levels are necessary.

- Commercial Auto Insurance: Policies covering vehicles used for business purposes, safeguarding against accidents and damages. Accurate representations of vehicle usage and coverage needs are essential.

FCA Application to Misrepresentations and Omissions

The FCA targets false or fraudulent claims submitted to the government. Misrepresentations or omissions in commercial insurance policies, if they lead to fraudulent claims against the government, can trigger FCA liability. This includes situations where an insurer knowingly misrepresents coverage details or intentionally underreports risks.

Potential FCA Liability for Commercial Insurers

Several situations can place a commercial insurer at risk of FCA liability:

- Inflated Claims: Insurers submitting inflated claims to the government for reimbursement of losses, when those losses are either non-existent or smaller than reported, can constitute FCA violations. A deliberate overstatement of losses can be a key indicator of fraud.

- Concealed Risks: Knowing and intentional concealment of potential risks or pre-existing conditions in the policy’s details, especially in the context of workers’ compensation or health insurance, can lead to FCA liability.

- Improper Premiums: Insurers failing to properly account for and collect premiums from policyholders or overcharging in a fraudulent manner can potentially trigger FCA action, if these practices cause the government to lose funds through misrepresentations.

- Unlawful Rebates or Discounts: Granting illegal rebates or discounts to clients that are concealed from the government can lead to FCA liability. Such actions can result in the government receiving less than expected.

Examples of False Claims, Does the false claims act apply to commercial insurance

Insurers might make false claims to the government in various scenarios:

- Submitting inflated claims for disaster relief: After a natural disaster, an insurer might inflate claims for damages to businesses to obtain greater reimbursement from government relief funds.

- Claiming for fraudulent losses: A business might submit fraudulent claims for losses caused by a non-existent event, with the insurer knowingly participating in the fraud.

- Overstating benefits in health insurance: An insurer might inflate the reported benefits to obtain more funding from government healthcare programs.

Insurance Policies and FCA Violations

Commercial insurance policies, intricate documents outlining coverage and responsibilities, can be a fertile ground for false claims. Understanding how the False Claims Act (FCA) applies to these policies is crucial for both insurers and policyholders. The FCA, designed to combat fraud against the government, can encompass actions within the commercial insurance sector if misrepresentations or omissions deceive the government in any way.Misrepresentations and omissions within insurance policies, whether intentional or negligent, can trigger FCA liability.

These issues span a wide spectrum, impacting premium calculations, policy coverage, and claim handling. The key is to recognize that any act, or lack thereof, that misleads the government regarding the value or nature of insurance coverage can constitute a violation. This includes situations where the government is indirectly involved, such as when a federally-backed loan is secured by the insurance policy.

Common Types of Misrepresentations in Commercial Insurance Policies

Misrepresentations in commercial insurance policies can take many forms. These often involve a deliberate or reckless disregard for the truth. Policyholders may intentionally overstate their risk exposure to secure lower premiums, or insurers might underrepresent coverage to reduce their liabilities. Common misrepresentations or omissions include:

- Inflated Loss Estimates: A policyholder might exaggerate the value of damaged property or the extent of injuries to receive a larger payout. This can be done deliberately or through negligence in assessing the true value of the loss.

- Concealed Prior Losses: A policyholder might fail to disclose past claims or incidents to obtain lower premiums, or insurers might intentionally omit material information from the policy to reduce their risk exposure.

- Mischaracterization of Policy Coverage: A policyholder or insurer may misrepresent the scope of coverage in the policy, including exclusions and limitations, to secure a deal or to avoid liability.

- Premium Calculation Errors: Insurers might employ inaccurate methods to calculate premiums, failing to account for relevant factors like risk assessment or industry standards. This could result in understated premiums if the government is involved in the process.

Potential FCA Violations Related to Premium Calculations, Policy Coverage, and Claims Handling

The FCA encompasses a wide array of potential violations related to insurance policies. The violations aren’t limited to blatant fraud; even unintentional errors or omissions can lead to liability if they affect the government’s interest.

- Premium Fraud: If an insurer knowingly or recklessly understates premiums or falsely claims deductions for premiums paid, the FCA could apply. This is especially true if the government is subsidizing or supporting the insurance.

- Policy Coverage Deficiencies: If a policyholder or insurer fails to provide adequate coverage, potentially affecting a government-backed loan or program, this could be a violation. The violation occurs when the government has a justifiable expectation of appropriate coverage.

- Claims Handling Abuses: Unjustified delays, denials, or improper handling of claims, particularly when the government is involved, can trigger FCA liability.

Comparison of FCA Application to Individual and Group Policies

The FCA’s application varies depending on whether the policy is for an individual or a group. The implications for the government’s interests and the potential impact on government programs are critical factors.

- Individual Policies: Violations in individual policies might have a smaller direct impact on the government, but if the policy is involved in a government-backed program, the consequences can be substantial.

- Group Policies: Violations in group policies, especially those involving significant numbers of policyholders, can have a larger impact on the government’s financial interests. The government’s stake in the outcome could be more significant.

Elements of a False Claim in Commercial Insurance

A false claim in the context of commercial insurance involves an intentional or reckless misrepresentation that leads the government to believe a policy meets certain criteria or offers a particular level of protection. This misrepresentation must be material and affect the government’s financial interest.

- Materiality: The misrepresentation must be significant enough to influence the government’s decision or action. It must have the potential to affect the government’s interest, whether financial or otherwise.

- Intent or Recklessness: The policyholder or insurer must have acted with either intent to deceive or reckless disregard for the truth. Negligence alone might not be sufficient.

- Government Interest: The government must have a demonstrable interest in the insurance policy. This could include situations where a federal program or loan is involved.

Failure to Comply with Regulatory Requirements and FCA Violations

Non-compliance with regulatory requirements in commercial insurance can easily trigger FCA violations. These requirements are put in place to maintain transparency and ensure policies meet a minimum standard of protection.

- Regulatory Compliance: Failure to adhere to regulatory standards, such as those concerning premium calculation or claims handling, can create conditions for a false claim. Regulatory oversight is essential to ensure accuracy and avoid FCA violations.

Government Programs and Commercial Insurance

Commercial insurers frequently interact with government programs, often handling claims and reimbursements related to healthcare, workers’ compensation, and other benefits. These interactions create a crucial intersection where the potential for false claims violations arises. Misrepresenting facts or inflating costs related to these programs can result in significant financial penalties for the insurer.The intricate web of contracts and regulations governing these programs provides ample opportunities for fraudulent activity.

Wondering if the False Claims Act applies to commercial insurance? Well, it’s a bit of a complicated question, and the answer isn’t always clear-cut. Think of it like this: if a company knowingly submits a fraudulent claim for commercial insurance, they might be in trouble. As for me and my house, we will serve tacos! as for me and my house we will serve tacos But that’s a whole different story! Ultimately, whether the False Claims Act applies in a commercial insurance context depends on the specifics of the situation and the exact nature of the claim.

So, while the answer is not as simple as a taco recipe, the potential for legal trouble remains.

Insurers may attempt to submit inflated claims or misrepresent the nature of services provided to maximize reimbursements, ultimately defrauding the government. This can manifest in various ways, from falsifying medical records to misclassifying workers’ compensation claims. Understanding the specific vulnerabilities within these programs is essential to identifying and preventing potential violations.

Specific Government Programs

Commercial insurers frequently interface with various government-funded programs, including Medicare, Medicaid, and workers’ compensation. These programs play a critical role in ensuring access to healthcare and financial support for injured workers, and are thus vulnerable to fraudulent activities. The complexity of these programs, with their diverse funding streams and reimbursement structures, can create avenues for misrepresentation.

Examples of False Claims, Does the false claims act apply to commercial insurance

Insurers might submit false claims by inflating the costs of medical services, falsely claiming that certain procedures were performed, or misrepresenting the extent of an injury or illness. In workers’ compensation, insurers could misclassify injuries, making false claims for benefits or exaggerating the duration of lost work time. A common example includes submitting bills for services not rendered or for services that were provided at a higher rate than what was actually charged.

Intermediaries and FCA Liability

Intermediaries, such as medical providers, adjusters, and other service providers, play a crucial role in the commercial insurance landscape. Their actions significantly influence the claims process and, consequently, the potential for FCA violations. If intermediaries knowingly participate in or facilitate false claims, they too face liability under the FCA. This includes instances where they inflate costs, misrepresent services, or fail to report inaccuracies.

The role of these intermediaries is critical because they often hold privileged information and have direct interaction with the government programs.

Billing Practices and FCA Violations

Billing practices play a vital role in insurance claims processing. Insurers must adhere to strict guidelines and regulations when submitting claims to government programs. Failure to comply can lead to FCA violations. Inaccurate coding, improper documentation, or submitting claims for services not actually provided are all potential violations. Ensuring compliance with billing regulations is essential to avoiding FCA liabilities.

A well-structured and scrutinized billing system can significantly reduce the risk of false claims.

Penalties for FCA Violations

| Violation | Penalties |

|---|---|

| Submitting false claims | Civil penalties ranging from $5,000 to $11,000 per false claim, plus treble damages. Criminal penalties can also apply, including fines and imprisonment. |

| Conspiracy to defraud | Civil penalties, treble damages, and criminal penalties, including fines and imprisonment. |

| Knowing participation in fraud | Civil penalties, treble damages, and criminal penalties. |

| Failure to report fraud | Civil penalties, treble damages, and potential criminal prosecution. |

Civil penalties can be substantial, and criminal penalties carry significant consequences, including imprisonment.

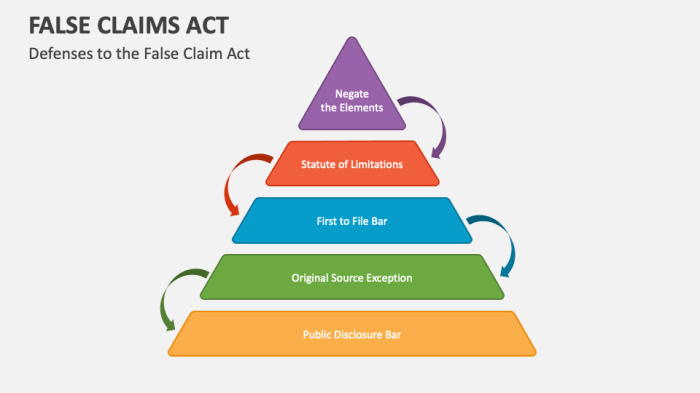

Statute of Limitations and Enforcement

The False Claims Act (FCA) provides a crucial avenue for recovering funds misappropriated from the U.S. government, and its application to commercial insurance presents a complex interplay of legal frameworks. Understanding the statute of limitations and the enforcement process is essential for both insurers and those potentially bringing a claim. The FCA’s reach into commercial insurance underscores its broad application and the importance of adhering to legal compliance.The statute of limitations for FCA claims is a critical factor in determining the timeframe within which a claim can be filed.

The limitations period is not uniform but varies depending on the specific circumstances of the case. In general, the clock starts ticking from the date the alleged fraudulent activity occurred, or in some instances, the date the claimant first discovered the fraudulent conduct. This timeframe is crucial for preserving evidence and ensuring the claim is filed within the allotted period.

Statute of Limitations

The statute of limitations for FCA claims is not a singular, fixed period. It is often governed by the relevant state and federal laws, which dictate the timeframe for initiating litigation in civil cases. The exact time period for filing an FCA claim is often tied to when the plaintiff knew or reasonably should have known about the alleged fraud.

This element of discovery can significantly influence the statute of limitations calculation. Different statutes of limitations may apply depending on the particular legal framework involved. For example, if the alleged violation involves a federal contract, federal statutes may govern the limitations period.

Process for Bringing an FCA Claim

The process for initiating an FCA claim against a commercial insurer involves several crucial steps. Initially, a potential claimant must gather substantial evidence to substantiate the claim of fraudulent activities. This evidence often includes detailed documentation of policy violations, communications, and financial records. This stage requires meticulous preparation and a clear understanding of the legal requirements. Once the evidence is gathered, the claimant can formally file a complaint with the appropriate court, outlining the alleged violations and requesting appropriate remedies.

Enforcement Examples

The FCA has been utilized in numerous instances against commercial insurers. One example involves an insurer that knowingly overcharged for coverage, misleading the government in calculating the premiums. This deceptive practice ultimately resulted in a substantial financial recovery for the government. Another case illustrates how an insurer engaged in deceptive practices regarding claims settlements, defrauding the government by under-paying for legitimate claims.

These examples highlight the FCA’s role in preventing and rectifying fraudulent activities in the commercial insurance sector.

Methods for Resolving Disputes

Several methods can be employed to resolve FCA disputes concerning commercial insurance. Negotiation is often a primary avenue for reaching a settlement outside of court. Mediation provides a neutral platform for facilitating communication and finding common ground. Arbitration offers a structured process for resolving disputes, often leading to a binding agreement. Litigation, while often the last resort, remains a viable option for pursuing claims when other methods fail.

Successful FCA Cases

Numerous successful FCA cases have involved commercial insurers. A notable case involved a large insurance company that misrepresented policy terms to the government, leading to significant financial penalties and restitution to the affected government programs. Another example involved an insurer that defrauded the government by inflating claims for losses. These cases demonstrate the FCA’s effectiveness in deterring fraudulent activities and safeguarding government funds.

The substantial financial recoveries in these cases underscore the potential impact of successful FCA actions.

Illustrative Scenarios

The False Claims Act (FCA) holds significant implications for commercial insurers, particularly those participating in government programs. Understanding potential violations is crucial for compliance and avoiding costly legal repercussions. The FCA encompasses a wide range of actions, from submitting fraudulent claims to misrepresenting coverage, and failure to comply with regulatory requirements. These scenarios highlight potential violations within specific contexts.

Potential FCA Violation Related to a Specific Government Program

A commercial insurer, specializing in worker’s compensation insurance, knowingly underreported the number of claims submitted to a state-funded workers’ compensation program. This underreporting was intended to reduce the insurer’s payments to the program, effectively defrauding the state. This deliberate misrepresentation of claim data directly violates the FCA, as it involves the submission of a false claim to a government program.

The insurer’s actions constituted a material misrepresentation to the government, intentionally minimizing payments due.

False Claims Related to Premium Calculation

An insurer calculates premiums for a program funded by the Department of Veterans Affairs (VA). The insurer falsely inflates the projected costs of claims, leading to significantly higher premiums. The insurer uses inflated projections, intentionally misrepresenting the expected costs, to increase premiums. This false calculation is a violation of the FCA, as the insurer is submitting a false claim to the government for higher premium amounts.

Wondering if the False Claims Act applies to commercial insurance? Well, imagine staying in a beautifully restored lighthouse keeper’s cottage at Cape Willoughby, experiencing the rich history of the area. Cape Willoughby Lighthouse Keepers Heritage Accommodation offers a unique blend of heritage and comfort. Ultimately, the False Claims Act’s application to commercial insurance is complex and requires legal counsel to navigate the specifics.

The inflated premiums ultimately affect the VA’s budget, and potentially, the availability of coverage for veterans.

Misrepresentation of Policy Coverage as a Potential FCA Violation

A commercial insurer sells policies promising comprehensive coverage for flood damage, while simultaneously limiting coverage to exclude certain types of flood-related losses. This is a clear misrepresentation of the policy coverage. The insurer misleads potential clients about the extent of flood coverage, essentially selling a product that does not match the advertised benefits. This misrepresentation of policy terms is a potential FCA violation, as it could be interpreted as a false claim related to the scope of coverage offered.

Failure to Comply with Regulatory Requirements Leading to FCA Violations

A commercial insurer operating in a state with stringent regulations for health insurance policies fails to maintain proper records of premium calculations. The insurer’s failure to comply with these state-mandated requirements could be considered a violation of the FCA, as this non-compliance creates a potential for false claims. The lack of documentation creates a loophole, enabling the insurer to potentially adjust claims and premiums without proper audit trails.

This omission could be seen as a means of circumventing proper regulatory procedures.

Fraudulent Claims Handling as a Possible FCA Violation

A commercial insurer handling claims related to a federal disaster relief program. The insurer processes claims fraudulently, paying out inflated amounts to specific individuals or businesses. This fraudulent claim handling is a direct violation of the FCA. The insurer is submitting false claims for payments that are not legitimately due, causing an unwarranted financial burden on the government program.

The insurer’s actions deliberately deceive the government program into paying for non-existent or exaggerated damages.

Legal and Regulatory Considerations

The False Claims Act (FCA) casts a long shadow over commercial insurance, demanding meticulous scrutiny of practices and procedures. Understanding the legal precedents and regulatory frameworks is crucial for navigating this complex landscape. Compliance with FCA provisions is paramount to avoid potential liability and ensure ethical conduct within the insurance industry.The Department of Justice (DOJ) plays a pivotal role in investigating and prosecuting FCA cases related to commercial insurance.

Their investigative powers, coupled with the substantial penalties for violations, highlight the significant consequences of non-compliance. This proactive stance emphasizes the importance of adhering to the letter and spirit of the FCA.

Relevant Legal Precedents and Regulations

The FCA’s reach extends beyond government contracts, encompassing a broad spectrum of commercial activities, including insurance. Landmark cases have established precedents for interpreting the Act’s provisions in insurance-related contexts. These cases illuminate the crucial elements that trigger FCA liability, particularly in situations involving fraud or misrepresentation in insurance policies.

Role of the Department of Justice

The DOJ, through its dedicated divisions, actively investigates and prosecutes FCA violations. This includes cases involving commercial insurance where fraudulent claims or inflated premiums are suspected. The DOJ’s investigative approach often involves extensive document review, witness interviews, and financial analysis. These rigorous methods aim to uncover evidence of FCA violations. Success in these cases hinges on the DOJ’s ability to demonstrate a clear link between the insurance company’s actions and the defrauding of the government.

For example, a commercial insurer knowingly submitting inaccurate claims related to government-backed programs could be subject to DOJ investigation.

Regulatory Bodies and Their Role

Several regulatory bodies oversee the commercial insurance industry, playing a significant role in FCA enforcement. State insurance departments and the National Association of Insurance Commissioners (NAIC) are examples of key regulatory bodies. Their roles encompass policy oversight, investigation of insurance fraud, and collaboration with the DOJ in cases of FCA violations. The NAIC, for instance, works to harmonize state insurance regulations, promoting a uniform approach to FCA compliance.

Regulatory Approaches in Different Jurisdictions

Jurisdictional differences in regulatory approaches to commercial insurance can impact FCA enforcement. For example, some states might have more stringent regulations regarding the reporting of questionable claims, creating a stricter environment for insurers. This variation requires a nuanced understanding of specific jurisdictional requirements to ensure compliance. Comparison of these regulatory approaches reveals the need for comprehensive legal counsel tailored to specific locations.

Evolving Legal Landscape

The legal landscape surrounding the FCA and commercial insurance is dynamic. Technological advancements, changing government regulations, and evolving interpretations of the FCA itself influence the regulatory landscape. This dynamic environment requires insurers to maintain a proactive approach to legal compliance, anticipating potential changes and ensuring their practices remain aligned with the current legal framework. Continuous monitoring of legislative developments and court rulings is critical.

Final Wrap-Up

In conclusion, the False Claims Act’s reach into the commercial insurance world is significant. Understanding the potential liabilities for insurers, the various types of violations, and the supporting legal framework is crucial. This exploration underscores the importance of meticulous compliance and transparency within the insurance industry, especially when dealing with government-funded programs. The potential penalties for violations are substantial, making this a topic of utmost importance for all parties involved.

FAQ Summary

Does the FCA apply to all types of commercial insurance policies?

No, the FCA’s application depends on the specific details of the policy and its interaction with government programs. Some policies are more susceptible than others.

What constitutes a “false claim” in the context of commercial insurance?

A false claim involves misrepresenting facts, omitting crucial information, or making fraudulent claims to government programs, thereby seeking payment for goods or services that are not legitimately due.

What is the statute of limitations for FCA claims related to commercial insurance?

The statute of limitations for FCA claims can vary depending on the specific circumstances. It’s crucial to consult with legal counsel for precise details.

What are some examples of how insurers might violate the FCA related to premium calculations?

Insurers might inflate premiums or manipulate calculations to increase their profits, or claim they provided coverage for items they didn’t cover.