First acceptance insurance pay bill—getting that first payment from your insurance company can be a total rollercoaster. It’s like finally getting that sweet, sweet reward after all the paperwork and hoops. This guide breaks down everything you need to know about understanding, receiving, and handling your first acceptance insurance pay bill, so you can totally avoid any last-minute stress.

This comprehensive guide covers the entire process, from understanding the concept of first acceptance insurance pay bills to potential issues and solutions. We’ll explore different insurance policies, payment methods, and the typical timeframe for receiving your payment. Get ready to totally dominate your insurance game!

Understanding the Concept

Right, so a “first acceptance insurance pay bill” is basically the initial payment you’re required to make after your insurance company has accepted your application and granted coverage. Think of it as the first instalment of your premium, confirming your commitment to the policy. This isn’t just for new policies; it can also apply to renewing policies where a change in coverage or terms necessitates a fresh payment.This initial payment kickstarts your insurance protection, essentially locking in the agreed-upon coverage for the period specified in your policy.

This differs from subsequent premium payments, which typically follow a regular schedule, like monthly or quarterly.

Types of Insurance Policies

Various insurance policies might involve a first acceptance pay bill. These include, but aren’t limited to, car insurance, home insurance, life insurance, and health insurance. The nature of the first payment will vary depending on the specific policy and the insurer. For example, a new car insurance policy often demands a larger initial payment, covering a portion of the full year’s premium.

Timeframe for Payment

The timeframe for receiving the first acceptance insurance payment is usually Artikeld in the policy documents or communicated by the insurance company. It’s generally within a few days or weeks of policy acceptance, with some insurers specifying a deadline. This timeframe ensures the insurance company can process the payment and activate your coverage promptly.

Payment Methods

The payment methods for the first acceptance insurance pay bill are varied, mirroring modern payment options. These include online banking transfers, debit/credit card payments, and cheque payments, with some companies also accepting cash. Different insurance providers might have preferred payment methods, often communicated within their application or policy documentation.

Key Components of the Bill

Right, so you’ve got your first acceptance insurance pay bill. Crucial to understand the nitty-gritty, mate. It’s not rocket science, but knowing the parts makes it way easier to decipher.This bill, like any other, is designed to be clear and concise. It lays out the details of your insurance coverage and the amount you owe. Understanding the structure and the jargon is key to avoiding any nasty surprises.

Essential Bill Components

This section Artikels the fundamental elements typically found on an acceptance insurance pay bill. Knowing these will make navigating the bill a breeze.

| Component | Description | Example |

|---|---|---|

| Policy Number | A unique identifier for your insurance policy. This is vital for locating your specific coverage. | 1234567890 |

| Policyholder Name & Address | Your name and address as they appear on the policy. Double-check for accuracy. | John Smith, 123 High Street, Anytown |

| Insurance Company Name & Address | The insurer providing your coverage. Crucial for contacting them. | Acme Insurance, 456 Main Street, Anytown |

| Bill Period | The dates covered by the bill. It shows the period for which the premiums are due. | 1st October 2024 – 30th November 2024 |

| Premium Amount | The total amount owed for the insurance coverage. Check the breakdown for any extras. | £125.00 |

| Deductible | The amount you pay out of pocket before the insurance company kicks in. | £500.00 |

| Payment Due Date | The date by which the payment is expected. Missing this can lead to penalties. | 15th December 2024 |

| Payment Method Options | Ways you can pay the bill (e.g., online, cheque, bank transfer). | Online banking, cheque, or bank transfer |

| Total Amount Due | The final amount payable, including any extras, interest or late fees. | £150.00 |

| Contact Information | Details for contacting the insurance company for inquiries or clarifications. | Phone number, email address, and online portal |

Bill Format and Structure

The bill’s format is typically straightforward. It’s designed for ease of comprehension. A clear layout ensures you can easily identify each component. Expect a professional-looking document with clear headings and columns, using bold text for important details.

Abbreviations and Technical Terms

Some bills might include abbreviations or technical terms. Understanding these helps you grasp the specifics of your coverage.

Examples: “PI” (for Public Liability), “LTD” (for Limited), “NCD” (for No Claim Discount).

The insurance industry uses these abbreviations to save space and time. Look for these on your bill.

Process of Receiving the Acceptance Insurance Pay Bill: First Acceptance Insurance Pay Bill

Navigating the process of receiving your first acceptance insurance pay bill can feel a bit like deciphering ancient runes, but fear not, it’s simpler than it seems. This section breaks down the steps, required docs, and tracking methods, ensuring you’re fully clued up on how to get your bill.

Bill Receipt Steps

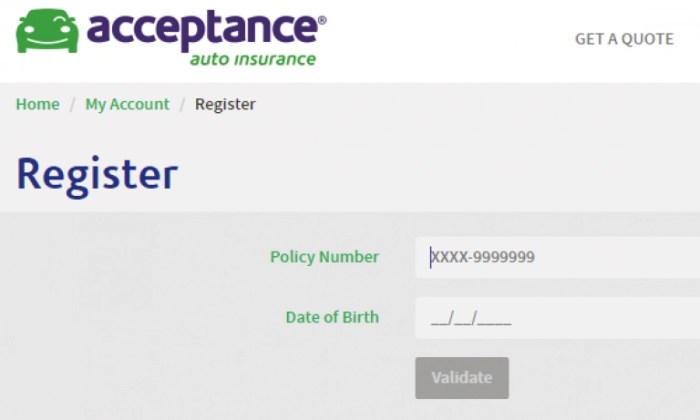

The process for receiving your acceptance insurance pay bill typically involves a series of actions. First, ensure your account details are up to date and accurately reflected on the insurance provider’s system. This is vital to prevent any delays or errors in the bill’s delivery.

- Account Verification: Verify your account information is correct and current with the insurance provider. Incorrect details can lead to delayed or incorrect billing.

- Bill Generation: The insurance provider generates the bill based on your policy terms and any applicable premiums.

- Bill Delivery Method: The bill is then delivered via the method you’ve designated in your policy, such as email, online portal, or physical mail.

- Review and Acknowledgment: Carefully review the bill for accuracy and complete all required actions as Artikeld. This might include payment confirmation or acknowledgment of receipt.

Required Documentation

Specific documentation requirements for receiving the bill vary depending on the insurance provider and the type of policy. Generally, you will need your policy details and possibly any supporting documents that were required during the application process. Keep a copy of everything, just in case.

- Policy Documents: Your insurance policy documents are crucial, containing specifics on your coverages and premium amounts.

- Payment Information: Your preferred payment method details (e.g., account numbers for online or bank transfer payments).

- Proof of Identity (if applicable): Some providers might request this to verify your identity.

Bill Status Tracking

Keeping tabs on your bill’s status is easy peasy. Most insurance providers offer online portals or customer service channels for checking bill status. Use these resources to avoid any surprises.

- Online Portals: Many providers have dedicated online portals where you can track your bill’s progress.

- Customer Service Channels: Phone calls or email correspondence with the customer service team can help you get real-time updates on the status of your bill.

Step-by-Step Guide

This guide provides a systematic approach to navigating the bill receipt process.

Initial acceptance of insurance payment for procedures often involves a pre-authorization process. This is frequently required by Burlington oral and maxillofacial surgeons burlington oral and maxillofacial surgeons for various surgical treatments, ensuring coverage and facilitating timely patient care. Subsequent claims processing for the first acceptance of insurance payment can vary based on individual insurance plans.

- Verify Account Details: Double-check your account information on the provider’s website or portal.

- Review Policy Documents: Carefully review your insurance policy for any details related to the bill, such as premium amounts and payment methods.

- Access Tracking Tools: Locate and access the bill tracking tools offered by the provider.

- Contact Customer Service (if needed): Reach out to customer service for clarification or assistance if you face any issues.

- Make Payment (if applicable): Complete the payment process according to the instructions on the bill.

Potential Issues and Solutions

Navigating the initial acceptance insurance pay bill can sometimes be a right pain, especially when things don’t quite go to plan. Common issues like discrepancies, delayed payments, or simply not understanding the bill can cause a fair bit of hassle. This section lays out potential problems and, crucially, how to sort them out.Understanding these potential issues and their solutions is key to a smooth payment process.

Having a clear plan of action for handling any problems will make the whole experience less stressful.

Common Bill Discrepancies

Mismatches between the bill and the actual coverage can lead to confusion and disputes. Incorrect premiums, missing or extra items, and inaccurate coverage periods are all common causes of disagreement. Carefully scrutinise every detail on the bill to spot any anomalies. Double-checking your policy documents and comparing them with the bill can prevent costly errors.

Delayed Payment Issues

Payment delays are frustrating and can impact your insurance status. Possible causes include technical glitches with the payment system, insufficient funds, or problems with the bank. Monitoring your account and communicating promptly with the insurer is essential. If the issue isn’t resolved within a reasonable time frame, escalation procedures are necessary.

Understanding the Bill’s Complexity

The complexity of the bill can be off-putting. Sometimes, the language used isn’t clear, or crucial details are missing. This section provides clear, concise information to help decipher the bill. A deeper understanding of the bill is vital for ensuring accurate payments and preventing potential disputes.

Problem Resolution Procedures

Addressing issues efficiently is paramount. Following the proper channels is key to a swift resolution.

- Contact the insurance provider directly: The initial point of contact should always be the insurer. Their dedicated customer service team can provide valuable assistance. This is the first port of call for any queries or problems.

- Review policy documents: Thoroughly checking the policy document can reveal answers to questions and resolve discrepancies. Comparing this to the bill will often reveal the source of the issue.

- Use online portals: Many insurance providers have user-friendly online portals for customers. These can be useful for checking account balances, reviewing claims, and submitting requests.

- Escalation procedures: If initial attempts to resolve the issue fail, escalating the matter to a supervisor or complaint department within the insurance company may be necessary. This step ensures your concerns are properly addressed.

Table of Solutions for Common Issues

This table provides a comparison of different solutions for common problems related to the first acceptance insurance pay bill.

| Issue | Solution 1 (Direct Contact) | Solution 2 (Policy Review) | Solution 3 (Online Portal) |

|---|---|---|---|

| Incorrect Premium | Request a clarification from the insurer. | Compare the bill to the policy for accuracy. | Verify the premium amount on the online portal. |

| Delayed Payment | Contact the insurer’s customer service. | Review payment history in policy documents. | Check payment status on the online portal. |

| Bill Complexity | Request a detailed explanation of the bill. | Consult the policy document for clarification. | Utilize the online portal’s FAQ or help resources. |

Contacting Relevant Parties

Knowing who to contact is crucial in resolving issues promptly.

- Insurance provider: The primary contact for any queries or problems concerning your insurance policy and pay bill. Their customer service line is usually a good starting point. Look for contact details on your policy document or the insurer’s website.

- Financial institution: If there are payment-related issues, contacting your bank or financial institution is essential to rectify any problems with the transaction.

Illustrative Examples

Right, so you’ve got the basics down on acceptance insurance pay bills. Now, let’s get practical. These examples will show you exactly what these bills look like in the real world.Understanding the format and content of these bills is key to avoiding any nasty surprises when it comes to payment.

Invoice Example

This is a common format, acting like a formal request for payment. Invoices typically detail the service rendered, the cost, and payment terms.

Invoice #12345 Date: 2024-10-27 To: Acme Corp. From: Alpha Insurance Ltd. Description: Acceptance Insurance Premium Amount: £1,500.00 Due Date: 2024-11-10 Payment Method: Bank Transfer Terms: Net 30 days Conditions: Full payment required within 30 days of invoice date. Failure to pay may result in late payment fees.

Receipt Example

A receipt confirms payment has been made.

It’s a record of the transaction.

Receipt #67890 Date: 2024-11-05 Paid By: Acme Corp. To: Alpha Insurance Ltd. Description: Acceptance Insurance Premium Amount Paid: £1,500.00 Payment Method: Bank Transfer Reference Number: 12345 Confirmation: Payment successfully processed.

Sample Bill (Table Format)

This table shows a more structured way of presenting the information. The responsive columns will adjust to different screen sizes.

| Item | Description | Amount (£) | Due Date |

|---|---|---|---|

| 1 | Acceptance Insurance Premium (Policy # ABC123) | 1,500.00 | 2024-11-10 |

| 2 | Late Payment Fee (if applicable) | 0.00 | N/A |

| 3 | Total | 1,500.00 | 2024-11-10 |

Understanding the Bill

The bill, regardless of format, should contain essential details. Look for:

- Invoice/Receipt Number: A unique identifier for the transaction.

- Date: The date of the invoice or receipt.

- Amount: The total sum due.

- Due Date: The date by which the payment is expected.

- Description: Details of the service or product for which payment is due.

- Payment Method: Preferred methods of payment.

- Terms and Conditions: Important clauses regarding payment, late fees, etc.

This is crucial to avoid potential issues and ensure smooth payment processes.

Comparison with Subsequent Bills

First acceptance insurance pay bills often differ from subsequent ones, primarily due to the initial assessment and subsequent adjustments. These initial bills act as a snapshot of the anticipated costs, which may need revisions as the insurance process progresses.

Understanding the nuances between the first bill and subsequent ones is crucial for accurate financial planning. This comparison examines the key variations in amounts, due dates, and other factors, providing a framework for managing your insurance expenses effectively.

Amounts, First acceptance insurance pay bill

| Bill Type | Amount Description | Potential Variance Explanation |

|---|---|---|

| First Acceptance Bill | Preliminary estimate based on initial data. | Often represents an estimated cost, which may adjust based on further assessments or discovered claims. |

| Subsequent Bills | Reflects finalized costs, adjusted claims, and any additional coverage. | Could be higher or lower than the initial bill depending on the complexity of the claim or revisions in the assessment. |

A crucial aspect to consider is the possibility of revisions in the assessment. These revisions can impact the final amount owed.

Due Dates

Due dates for subsequent bills often align with the payment schedule Artikeld in the initial policy agreement, unless there are extenuating circumstances or agreed-upon adjustments.

Subsequent bills might reflect adjustments in the overall payment plan, aligning with the insurer’s established schedule or agreed-upon changes.

Key Factors and Format Variations

The format of subsequent bills can vary, potentially incorporating details not present on the initial acceptance bill. This is a standard procedure. Examples include revised coverage details, updated policy summaries, and any adjustments made to the premium.

Subsequent bills might include a detailed breakdown of costs, which wasn’t present on the first bill. This breakdown often clarifies the components of the total premium.

Initial acceptance of insurance payment for veterinary care often hinges on timely submission of bills. A significant factor in ensuring timely payment is the clarity and accuracy of the documentation, including the specifics of the pet’s needs, such as food choices. For example, a pet owner choosing President’s Choice Nutrition First dog food ( president’s choice nutrition first dog food ) may experience a smoother payment process if the associated veterinary care is properly documented.

This, in turn, directly influences the speed of first acceptance of insurance pay bills.

Reasons for Differences

Variations in amounts often stem from a deeper examination of the claim or policy. The first bill serves as an initial estimate, while subsequent bills reflect the finalized evaluation. For instance, a comprehensive assessment of the damage might lead to a higher amount in a subsequent bill.

Differences in format, such as the inclusion of detailed breakdowns or policy summaries, aim to provide a clearer understanding of the policy and associated costs. The added detail enhances transparency in the insurance process.

Implications and Consequences

Right, so you’ve got your first acceptance insurance pay bill. Crucially, understanding the implications and potential consequences is key to avoiding any nasty surprises later. This isn’t just about ticking a box; it’s about making sure your policy stays active and your premiums are covered.This section delves into the ramifications of receiving this bill, covering both the positive and, more importantly, the negative outcomes of not handling it correctly.

Knowing the drill can save you a lot of hassle down the line.

Implications of Receiving the First Bill

The initial acceptance bill sets the tone for your entire policy tenure. It establishes payment expectations and Artikels the terms of your insurance agreement. Understanding these terms is vital for a smooth policy experience.

Consequences of Late Payment

Failing to pay the first acceptance bill on time can trigger a cascade of events, impacting your insurance coverage. A missed payment could lead to a lapse in coverage, potentially voiding the policy. This is a serious issue, as it means you’re no longer protected by the insurance policy. Furthermore, late payments often come with penalties and additional fees, which can add up quickly.

Consider this a crucial lesson in responsible financial management.

Flowchart of Potential Outcomes

A flowchart illustrating the possible outcomes based on payment status is presented below.

Legend:

- Payment Received On Time: Policy remains active. Premium paid. Good standing with insurer.

- Payment Received Late: Policy remains active. Penalties or interest added to bill.

Potential for late payment fees or surcharges.

- Payment Not Received: Policy becomes inactive. Coverage ceases. Possible cancellation of policy.

Note: Specific outcomes vary by insurance provider. This is a generalized illustration.

Importance of Understanding Terms and Conditions

The terms and conditions of the acceptance insurance pay bill are not just legalese; they’re the bedrock of your policy. Understanding the details of these conditions, including payment deadlines, late payment penalties, and any other clauses, is paramount. This proactive approach ensures you’re aware of your obligations and helps avoid any unforeseen problems. Scrutinize every line, as these terms define your rights and responsibilities.

Don’t just glance; take the time to thoroughly comprehend the details.

Final Conclusion

So, you’ve made it through the first acceptance insurance pay bill process. Hopefully, this guide has helped you navigate the whole thing smoothly. Remember, understanding the bill, payment methods, and potential issues is key to avoiding any headaches down the road. Now you’re totally prepared for future insurance payments and can confidently tackle any related issues. Peace out!

FAQs

What if I don’t receive my first acceptance insurance pay bill on time?

Contact your insurance provider immediately to inquire about the status of your bill. They should be able to tell you the reason for the delay and provide an estimated timeframe for receiving the payment.

What are the different types of insurance policies that might involve a first acceptance pay bill?

Different types of insurance policies, like auto, home, health, and life insurance, can have first acceptance pay bills. The specific requirements and process will vary based on the policy type and provider.

How do I track the status of my first acceptance insurance pay bill?

Most insurance providers offer online portals or customer service phone lines to track your bill’s status. Check your account online or contact their customer support.

What are some common issues that might arise with first acceptance insurance pay bills?

Common issues could include errors on the bill, discrepancies in the policy details, or delays in payment processing. The guide will provide potential solutions to these problems.