Is self defense insurance worth it – Is self-defense insurance worth it? This exploration delves into the spiritual dimensions of personal protection, examining whether financial safeguards align with the path of self-empowerment. Beyond the material benefits, we’ll uncover the deeper meaning of safeguarding your well-being and how this choice reflects your spiritual journey.

This analysis considers various facets of self-defense insurance, including policy specifics, financial implications, and real-world scenarios. It also compares insurance to alternative self-defense methods, like martial arts training and personal safety measures, helping you weigh the options and choose what resonates most deeply with your values and goals. The ultimate goal is to empower you with the wisdom to make a decision that aligns with your inner compass and the higher purpose of your existence.

Understanding Self-Defense Insurance: Is Self Defense Insurance Worth It

Self-defense insurance is a specialized type of legal protection designed to cover individuals in situations where they are forced to use physical force in self-defense. It differs significantly from standard liability insurance, focusing explicitly on the legal ramifications of defensive actions. This insurance type provides a safety net for those who may face legal challenges stemming from a justifiable use of force.Self-defense insurance policies aim to mitigate financial and legal risks that can arise from legitimate acts of self-defense.

Coverage typically includes legal fees, court costs, and potential settlements, offering financial support to those who may face civil lawsuits or criminal charges in such situations. This type of insurance is not a guarantee of acquittal, but it acts as a crucial financial support system.

Defining Self-Defense Insurance Policies

Self-defense insurance policies are designed to cover legal expenses and potential settlements if an individual is accused of using force in self-defense. This insurance can be especially helpful in protecting against the financial burden of legal battles that often accompany such accusations. These policies are distinct from standard liability insurance, which typically covers harm caused by negligence.

Types of Self-Defense Insurance Policies

Several types of self-defense insurance policies are available, each with varying coverage amounts, deductibles, and exclusions. Policies can be tailored to specific needs and circumstances, ensuring that individuals have appropriate financial protection. A comprehensive policy should address a wide range of potential scenarios and provide ample legal support.

- Basic Self-Defense Policies: These policies typically cover a limited range of legal expenses, such as attorney fees, and offer a basic level of protection. They might not cover all potential costs associated with self-defense cases.

- Comprehensive Self-Defense Policies: These policies provide broader coverage, encompassing a wider range of legal expenses, including expert witness fees, court costs, and potential settlements. They often have higher premiums but offer more robust financial protection.

- Customized Self-Defense Policies: Some insurance providers allow for the customization of self-defense policies to meet specific needs. This approach is particularly beneficial for individuals involved in professions where self-defense situations are more common.

Common Scenarios Covered by Self-Defense Insurance

Self-defense insurance can be relevant in a variety of situations where the use of force is deemed necessary. This insurance is designed to provide protection in circumstances where individuals might be held legally responsible for their actions.

- Home Defense: If an individual is forced to use physical force to defend themselves or their family within their home, this insurance can provide financial protection during legal proceedings.

- Defense Against Assault: If an individual is assaulted and forced to use self-defense, this insurance can cover the costs of legal representation and potential settlements.

- Defense in Public Places: In scenarios where an individual is threatened in public and uses force in self-defense, this type of insurance can help manage legal and financial risks.

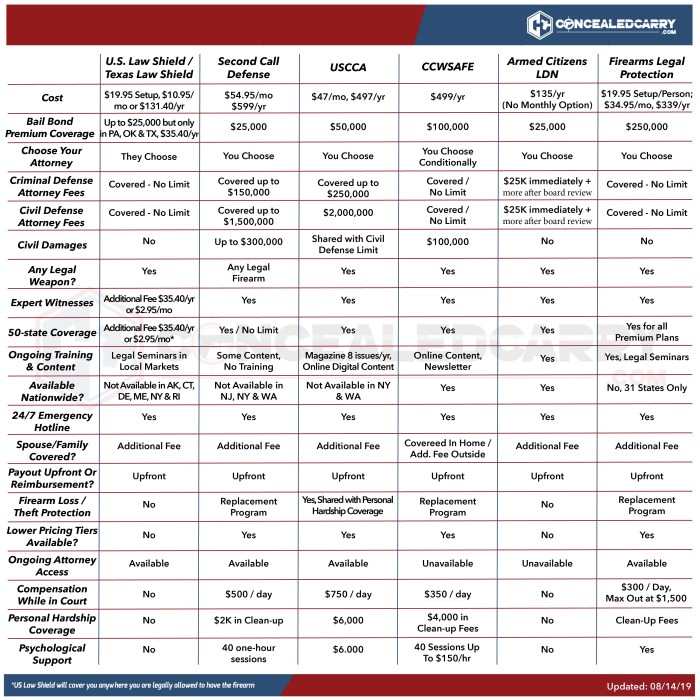

Comparing Self-Defense Insurance Policies

The following table Artikels key features of different self-defense insurance policies, enabling comparison based on coverage, deductibles, and exclusions.

| Policy Type | Coverage Amount | Deductible | Exclusions |

|---|---|---|---|

| Basic | $50,000 – $100,000 | $1,000 – $5,000 | Criminal charges, intentional acts of violence |

| Comprehensive | $100,000 – $500,000+ | $5,000 – $10,000+ | Acts of recklessness, pre-meditated actions |

| Customized | Variable | Variable | Policy-specific exclusions |

Evaluating Policy Costs and Benefits

Self-defense insurance, while a growing area, remains relatively niche. Understanding the costs and potential benefits is crucial before considering purchasing a policy. Evaluating these factors against alternative self-protection methods will provide a clearer picture of its value proposition.Policy costs vary significantly, impacting the overall financial viability of such insurance. Premiums depend on numerous variables, creating a complex landscape for consumers to navigate.

The potential for financial recovery in specific circumstances, when weighed against the premium, ultimately determines if the policy is worthwhile.

Considering self-defense insurance? Securing a safe environment is paramount, especially when considering a new place like apartments in Berkshire County, MA. Apartments in Berkshire County, MA offer a range of options, but safeguarding yourself remains crucial. Ultimately, whether self-defense insurance is worthwhile depends on your individual circumstances and perceived risk factors.

Typical Costs of Self-Defense Insurance Plans

Insurance premiums are influenced by a multitude of factors, including location, coverage scope, and policyholder characteristics. A comprehensive policy that extends beyond basic liability protection will likely command a higher premium. Premiums are also impacted by the insured’s age, gender, and profession.

- Location: Premiums in high-crime areas tend to be higher due to the perceived higher risk. A policy covering a city known for violent crime will cost more than one covering a rural area.

- Coverage Scope: Policies offering extensive coverage, such as legal representation or medical expenses in addition to liability protection, typically have higher premiums.

- Policyholder Characteristics: Age, gender, and occupation can influence premiums. Younger policyholders, especially those in high-risk professions, may face higher costs.

Examples of Policy Premiums and Variations

Premiums can vary widely, but a general guideline might see premiums ranging from $50 to $500 per year. Specific examples are hard to come by due to the limited availability of publicly available data. However, factors like coverage limits and policy specifics will affect the price. A policy that includes coverage for a wider range of self-defense situations, such as liability and medical expenses, will command a higher price than one limited to liability coverage alone.

Potential Financial Benefits

Self-defense insurance can provide financial protection in situations where a person is legally justified in using force. This protection can cover legal fees, medical expenses, and even compensation if a claim arises from an incident. The benefits are particularly significant in cases where legal expenses and potential compensation claims are substantial.

Potential Drawbacks of Self-Defense Insurance

One potential drawback is the lack of standardized coverage. Policies may have limitations on the types of situations covered or the amount of compensation offered. Furthermore, a policy may not cover every possible scenario, leaving individuals vulnerable in some situations. Insurance might not be the only, or even the best, solution for self-protection.

Comparing Self-Defense Insurance with Alternative Solutions

Alternative solutions like personal safety courses, self-defense training, or situational awareness programs offer distinct benefits. These methods can equip individuals with practical skills and knowledge to enhance their safety without the cost of insurance premiums. A blend of strategies, combining training with preventative measures, might prove more effective than relying solely on insurance.

Cost, Benefits, and Scenarios Table, Is self defense insurance worth it

| Scenario | Potential Costs | Potential Benefits |

|---|---|---|

| Accidental injury during self-defense | Potential legal fees, medical expenses | Insurance could cover legal representation and medical expenses |

| False accusation of aggression | Legal fees | Insurance could cover legal defense |

| Self-defense in a high-crime area | Higher premiums | Potential for substantial financial recovery in a legal dispute |

| Self-defense involving a significant injury | Potentially high legal and medical expenses | Comprehensive insurance could cover substantial costs |

Assessing Coverage and Exclusions

Self-defense insurance policies, while offering a degree of protection, are not a guarantee against all legal and financial repercussions. Understanding the specifics of coverage and potential exclusions is crucial for making an informed decision. Careful review of policy terms and conditions is paramount to avoid unpleasant surprises.Comprehensive knowledge of coverage and exclusions is essential for a clear understanding of the policy’s limitations.

This empowers individuals to assess whether the insurance aligns with their needs and risk tolerance. Knowing what situations the insurance does

not* cover allows for proactive planning and risk mitigation.

Typical Coverage Offered

Self-defense insurance policies often provide coverage for legal fees, court costs, and potential settlements in situations where the insured successfully defends themselves. This may include representation by legal counsel and expenses associated with preparing a defense. Some policies also offer coverage for lost income if the insured is unable to work due to a self-defense incident. The extent of coverage, however, varies greatly depending on the specific policy.

Common Exclusions

A crucial aspect of self-defense insurance is identifying the situations it doesnot* cover. Exclusions often relate to pre-existing conditions, specific actions taken, or circumstances surrounding the self-defense event. Carefully reviewing the policy’s exclusions is essential to avoid misunderstandings and disappointments.

Considering self-defense insurance? While securing your safety is paramount, a wise investment also considers your future. For example, if you’re looking to relocate to a new home, exploring properties like maison a vendre cote de beaupré could lead to a more secure and fulfilling life. Ultimately, the value of self-defense insurance depends on your individual circumstances and risk assessment.

Don’t just react, analyze and make informed choices.

Importance of Policy Review

Thorough review of policy terms and conditions is vital before purchasing self-defense insurance. This includes a detailed examination of the policy’s scope of coverage, the limitations of the coverage, and the specific situations that fall outside the policy’s protection. Policies may differ significantly in their coverage, and understanding the nuances is critical for making an informed decision.

Situations Not Covered

Self-defense insurance does not typically cover actions taken in situations where the insured initiated the conflict or acted in a manner that was deemed reckless or excessive. Furthermore, if the incident occurs under the influence of drugs or alcohol, the policy may not apply, or the coverage may be limited. Situations involving intentional or premeditated harm are typically excluded.

Policy specifics are crucial to understanding the boundaries of coverage.

Table of Common Exclusions and Limitations

| Exclusion Category | Description | Example |

|---|---|---|

| Initiating Conflict | Actions taken by the insured that provoked or initiated the conflict. | If the insured instigated a fight, the policy may not cover the resulting legal costs. |

| Reckless or Excessive Force | Use of force beyond what is reasonably necessary for self-defense. | If the insured used excessive force, the policy might not provide coverage for injuries sustained by the other party. |

| Pre-existing Conditions | Conditions or situations that existed before the policy was purchased. | If the insured had a history of violence or aggression, the policy might exclude claims arising from such issues. |

| Intentional Harm | Actions intended to cause harm to another person. | If the insured intentionally harmed someone, the policy will likely not provide coverage. |

| Intoxication | Situations where the insured was under the influence of drugs or alcohol. | If the insured was intoxicated during the incident, the policy might not cover the legal costs. |

Examining Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into the real-world experiences of self-defense insurance policyholders. These firsthand accounts provide a critical perspective, going beyond the policy specifics to reveal the practical application and overall value of the coverage. Analyzing both positive and negative feedback helps assess the insurance’s effectiveness and identify areas for improvement.Understanding the perspectives of satisfied and dissatisfied customers allows for a more nuanced evaluation of the insurance’s merits.

This approach moves beyond theoretical assessments and incorporates the practical considerations that impact policyholders. Examining testimonials and reviews, therefore, allows a more comprehensive understanding of self-defense insurance’s practical application.

Positive Customer Experiences

Customer feedback often highlights the peace of mind provided by self-defense insurance. Policyholders frequently express gratitude for the coverage’s reassurance in potentially dangerous situations. The security offered by the insurance can translate to a more secure feeling in daily life. Many reviews mention the ease of filing claims, the prompt response from customer service, and the clarity of policy terms.

- A satisfied customer might say, “I felt so much safer knowing I had this coverage. It’s a huge weight off my mind, knowing I’m protected in a variety of situations.” This demonstrates the psychological benefits the insurance offers.

- Another positive review could mention, “The claim process was straightforward and efficient. I received a prompt response and settlement, and the whole experience was stress-free.”

- A third example might highlight the clarity of the policy wording, stating, “The policy language was very clear, explaining exactly what was covered and what wasn’t. This helped me understand the insurance’s limits and scope.”

Negative Customer Experiences

While positive experiences are prevalent, negative reviews also provide important insights. Some customers express dissatisfaction with the limitations of the coverage, citing exclusions or insufficient coverage in certain scenarios. Other complaints may center on the claims process, mentioning delays or complications in receiving payouts.

- A dissatisfied customer might state, “The policy excluded many situations where I felt I needed protection, and the coverage felt inadequate for my needs.”

- Another complaint might focus on the claim process, mentioning, “The claim process was extremely complicated and time-consuming. I had to jump through hoops to get my claim settled.”

- A third example might point to unclear policy language, saying, “The policy wording was ambiguous, making it difficult to understand what was covered. This uncertainty created a lot of anxiety.”

Recurring Themes in Reviews

Analyzing customer feedback reveals recurring themes in both positive and negative reviews. Positive reviews consistently highlight the peace of mind and perceived security offered by the insurance. Negative reviews, conversely, often emphasize inadequate coverage, complicated claims processes, and unclear policy language.

| Category | Positive Aspect | Negative Aspect |

|---|---|---|

| Peace of Mind | Increased safety and security | Inadequate coverage for specific situations |

| Claims Process | Prompt and efficient claim handling | Delayed or complicated claim resolution |

| Policy Clarity | Clear and understandable policy language | Ambiguous or confusing policy wording |

Using Customer Feedback to Evaluate Value

Customer reviews and testimonials provide a critical tool for evaluating the value of self-defense insurance. By analyzing both positive and negative feedback, a comprehensive picture emerges of the insurance’s strengths and weaknesses. This data-driven approach can help individuals make informed decisions about purchasing self-defense insurance. Understanding the experiences of others can help individuals determine if the coverage meets their specific needs.

Comparing with Other Self-Defense Options

Self-defense insurance is one option among several strategies for personal safety. Understanding the alternatives allows for a more informed decision regarding the best approach for individual needs and circumstances. Evaluating the costs, benefits, and limitations of various self-defense methods is crucial for creating a comprehensive safety plan.Self-defense insurance is not a substitute for proactive measures. It provides a financial safety net in the event of an incident, but does not address the underlying risks of dangerous situations.

Other self-defense strategies can significantly enhance personal safety, and often at a lower cost. This section explores alternative methods and compares their effectiveness and cost-efficiency to self-defense insurance.

Martial Arts Training

Martial arts training equips individuals with physical and mental skills to defend themselves. Learning techniques like self-defense maneuvers, striking, and grappling can increase confidence and ability to respond to potential threats. Different styles emphasize various aspects, such as speed, strength, or strategy.Consistent training builds physical fitness, reaction time, and self-awareness, crucial for deterring and managing confrontations. The cost of martial arts varies widely depending on the style, instructor, and frequency of training.

Some styles, like Krav Maga, focus on realistic self-defense techniques, while others, like Aikido, emphasize non-violent defense. The effectiveness of martial arts training depends heavily on the dedication and consistency of the practitioner.

Personal Safety Measures

Implementing proactive safety measures significantly reduces the likelihood of encountering dangerous situations. These include situational awareness, avoidance strategies, and the use of personal safety devices.Situational awareness involves being mindful of one’s surroundings and potential risks. Avoidance strategies focus on avoiding high-risk areas or situations. Personal safety devices like pepper spray or alarms can provide a deterrent and aid in escaping potentially dangerous encounters.

The cost of these measures is relatively low, ranging from the price of a self-defense spray to the cost of a security system.

Cost-Effectiveness Comparison

Self-defense insurance provides financial protection but may not be cost-effective compared to other options. Martial arts training offers long-term benefits in self-defense skills but requires consistent effort and expense. Personal safety measures are affordable and readily implemented, with the lowest upfront cost.

| Self-Defense Option | Costs | Benefits | Suitability |

|---|---|---|---|

| Self-Defense Insurance | Premiums can vary significantly | Financial compensation for injuries | Suitable for individuals seeking financial protection |

| Martial Arts Training | Tuition fees, equipment | Improved self-defense skills, fitness | Suitable for individuals seeking long-term self-defense enhancement |

| Personal Safety Measures | Low upfront cost | Increased situational awareness, avoidance strategies | Suitable for individuals seeking immediate and practical safety improvements |

Self-Defense Insurance within a Personal Safety Plan

Self-defense insurance can be a component of a comprehensive personal safety plan. It acts as a financial safeguard, supplementing other methods like martial arts training or personal safety measures. A robust safety plan incorporates various elements to reduce risks and improve personal security. It should be tailored to individual circumstances and risk profiles.

Outcome Summary

Ultimately, the decision of whether self-defense insurance is worth it is deeply personal. Consider not just the financial aspects but also the alignment with your spiritual journey and personal safety plan. This exploration highlights the importance of self-awareness and a holistic approach to personal security, inviting you to reflect on what truly matters in protecting yourself on multiple levels.

FAQ Resource

Does self-defense insurance cover all types of self-defense situations?

No, self-defense insurance policies typically have exclusions and limitations. Carefully review the policy’s terms and conditions before making a decision.

What are some alternative methods to self-defense insurance?

Alternative methods include martial arts training, personal safety courses, and implementing preventative measures. Evaluate the costs and benefits of each option.

How does self-defense insurance affect my personal liability?

This depends on the specific policy. Review the policy’s language concerning liability to understand how it might affect you in self-defense situations.

What are the typical costs associated with self-defense insurance?

Costs vary based on location, coverage amount, and other factors. Research different policies to find one that aligns with your budget.